Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

Imagine you come back home exhausted, and your phone charger disappears, or you need an urgent birthday present for your friend or you are unable to find ingredients while cooking a meal but now you can get it in 10 minutes via a delivery service. This is due to the rise of Quick Commerce where swiftness functions as a standard operating pattern.

Modern urban shoppers have experienced a complete shift in their shopping behavior through the emergence of quick commerce during the time frame where “right now” defines expectations. Q-commerce represents a highly evolved version of e-commerce which emerged due to the fusion of digital connectivity, changing consumer life patterns and relentless drive for convenience. All products including groceries and electronics and beauty essentials and medications can be purchased and delivered to your doorstep within a few taps of your phone in under ten minutes.

The Indian Q-commerce industry has exploded as Blinkit, Zepto, Swiggy Instamart and BigBasket have joined forces in their pursuit of 10-minute delivery. Getir along with Gopuff and Gorillas represent global companies that both transform urban logistics operations and alter consumer demand on a worldwide scale.

This blog explores the entire spectrum of the quick commerce transformation by examining its historical evolution alongside expansion drivers, main industry participants, shifting market patterns and delivery speed obstacles as well as possible industry directions. The emergence of Q-commerce has revolutionized global shopping practices by providing rapid delivery services to customers.

It’s an organic development of e-commerce, meant to meet today’s consumers’ need for speed, convenience, and impulse gratification. Q-commerce follows a hyperlocal approach, depending on dark stores (small local warehouses) and tech-enabled logistics to manage stock and delivery routes in real-time.

Q-commerce operates through a distributed inventory system as its fundamental support structure. Modern companies are shifting from warehouse centralization toward operating dark stores which are small fulfillment centers placed for optimized delivery locations. The facilities operate exclusively for quick and efficient delivery operations and are inaccessible to regular customers.

The combination of AI-powered inventory analysis with optimization algorithms and instant order tracking supports companies to process many thousands of daily orders quickly but efficiently.

India’s socio-economic and cultural landscape offers fertile ground for q-commerce to thrive. Here’s why this model is tailor-made for the Indian urban consumer:

More than 50% of India’s population is below the age of 30, and most urban consumers primarily use mobie phone for online purchases. They cherish instant gratification, convenience, and digital-first experiences. Q-commerce connects with this mentality by providing what they need, right when they need it—most often in less than 15 minutes.

Urban India’s traffic is infamous. Just a 2-kilometer trip to the mall will take up 20–30 minutes, especially during the rush the rush hours. Q-commerce removes the inconvenience, converting time into money effectively. It’s not just a service—but a time convenience.

With more than 300 million active UPI users and ldata availability at ow-cost, placing and paying for orders takes mere seconds. This level of frictionless transaction capability makes quick commerce not only possible but preferred.

Unlike Western households that shop weekly, Indian consumers prefer smaller, more frequent purchases. This cultural norm aligns perfectly with q-commerce, which makes it easy to order only what’s needed, when it’s needed.

Need a cake for a last-minute celebration or snacks for unexpected guests? Q-commerce has made impulse buying seamless, creating new micro-moments for brands to capture consumer attention and spend.

COVID-19 accelerated digital trends adoption in India. Even consumers who were skeptical of online grocery buying became regular users. The habit of ordering online has persisted post-pandemic, helping q-commerce become a mainstream preference.

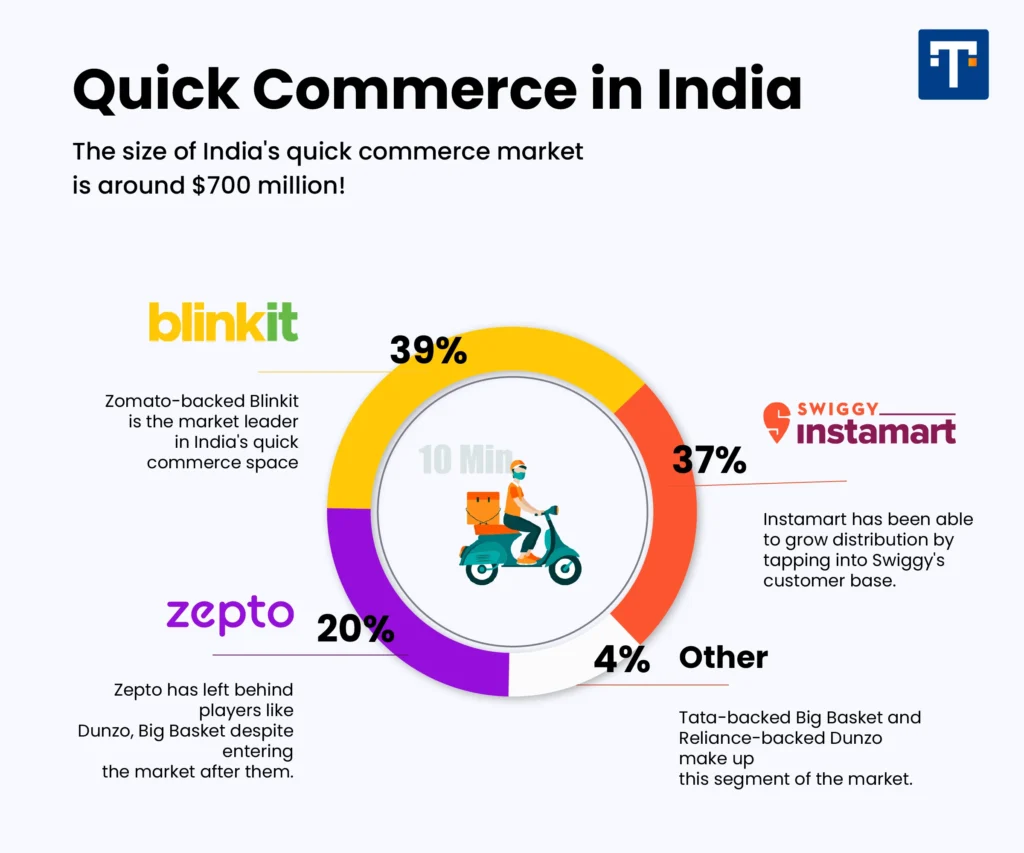

India’s q-commerce boom has seen three clear market leaders emerge, each with a unique operating model and brand proposition.

Zepto was established by Stanford alumni Kaivalya Vohra and Aadit Palicha who centered their branding concept on youthfulness and speed. Zepto operates its retail network through the dark store approach which helps it in fulfilling operations from inventory solutions and package preparation to final delivery. Its branding—bright, fast, and full of energy—appeals directly to the Gen Z and millennial consumer base. Zepto engages aggressively in metropolitan city expansion because metropolitan consumers most strongly desire expedient services.

Previously known as Grofers, Blinkit rebranded with a stronger emphasis on rapid delivery. Now funded by Zomato, it runs a hybrid model of dark stores and partner stores to grow rapidly while keeping costs in check. Its greatest strength lies in technology-driven logistics and ease of integration into the Zomato platform, enabling high-density service areas and consistent user experience across food and grocery.

Swiggy Instamart taps into the food delivery DNA of its parent company, Swiggy. Instamart distinguishes itself from the other two competitors through its extensive ecosystem model. The company provides grocery delivery through its Swiggy’s food service application under the Swiggy One subscription model. The company presents itself as a leading lifestyle-focused service through its premium group of products and attractive app user experience and carefully selected merchandise choices.

| Feature | Zepto | Blinkit | Swiggy Instamart |

| Model | Dark stores | Hybrid (dark + partner) | Hybrid with ecosystem |

| USP | Speed, Gen Z focus | Tech integration, Zomato synergy | Premium positioning, wide assortment |

| Geographic Reach | Metro-centric | Pan-India in metros | Pan-India via Swiggy |

| Brand Positioning | Youthful, edgy | Smart, fast | Trustworthy, premium |

The quick commerce market in India shows strong signs of rapid expansion. According to market.us the industry shows an anticipated expansion that will boost its value from $75.9 Billion in 2023 to $626.5 Billion by 2033 with a CAGR of 23.5%. This growth is mainly concentrated in Bengaluru, Mumbai, Delhi-NCR, Hyderabad and Pune along with other metro and Tier 1 cities.

The market shows extraordinary growth because India has two key structural advantages: a dense population and extensive smartphone and UPI adoption which enables effective local deliveries. The leading players in this market including Zepto and Blinkit and Swiggy Instamart address these structural features through service extensions which now reach electronic merchandise and apparel goods and personal care items.

Q-commerce expansion extends past metropolitan regions towards smaller cities which find advantage in its practicality and cost-effective propositions. The retail sector in India will see q-commerce grow rapidly with a predicted 67% compound annual growth rate (CAGR) from 2025 to 2030 which signals its future dominance of the market.

While the quick commerce model appears consumer-friendly, it’s riddled with structural and economic challenges that players must overcome to stay sustainable.

Operating a grocery delivery service that delivers orders valued at ₹150 within 15 minutes becomes profitable with high volume and order density. Such business operations function through minimal to no profit margins that need overwhelming volume and continuous investor support for survival. Long-term sustainability depends on Average Order Values (AOV) improvement and reduced fulfillment costs from players.

Dark stores require real estate, refrigeration, staff, and 24×7 maintenance. Multiply this across dozens or hundreds of locations, and you’re looking at significant operational overheads. Choosing locations that balance rent with reach is a delicate challenge.

To stay competitive, brands offer deep discounts, free deliveries, and referral bonuses. But this leads to a high cost of customer acquisition (CAC) and limited loyalty. If another app offers a ₹30 coupon, many users are quick to switch, creating a race-to-the-bottom on pricing.

Delivery executives make up the backbone of q-commerce but often work under long hours, poor pay, and high levels of delivery stress. Burnout, road safety, and pay justice are causing increasing concern. With changing labour laws, companies will have to rethink how they deal with gig workers.

Matching inventory to hyperlocal demand is tough. Stockouts or expired items can tarnish the customer experience. AI helps, but achieving predictive accuracy at the neighborhood level remains a work in progress.

Quick commerce has evolved from a short-term trend into an industry force that alters customer expectations for diverse product categories. Speedy delivery has become the critical question for businesses rather than whether to offer it at all. Businesses need to determine their fastest possible delivery time while maintaining operational profit.

The D2C brands and retailers along with marketers now have access to fresh strategic opportunities through q-commerce. Business success under these conditions requires stronger supply chain links and Artificial Intelligence managed logistics services while developing better insights into consumer buying patterns. The entire customer journey moves towards instant results as companies run temporary flash sales and minimize packaging time.

Future trends in q-commerce show promise with rural supply service and drone package delivery systems alongside automation of dark store operations through AI applications. Retail companies that achieve equilibrium between expedition and scale together with environmental sustainability will drive retail innovation in India throughout the upcoming decade.

Sign up to receive our newsletter featuring the latest tech trends, in-depth articles, and exclusive insights. Stay ahead of the curve!