Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

The transition of India into a cash-free economy has achieved remarkable results through the implementation of QR codes and digital wallets. The radical transformation of money systems in India during the last few years comes through fearless startup entrepreneurs with prolific thinking about financial systems and an innovative approach.

Fintech works beyond being an industry in India as it represents an advanced social revolution. Indian citizens experienced complete change of financial practices as digital technology changed how they saved and managed their money. This was a result of the provision of rapid transactions along with simplified investment solutions and better credit options. With advanced UPI systems, regulators approved progress and easy access of smartphones provide optimal market conditions for the growth of new financial services. In addition, these startups are beyond the benefits of their convenience as they form financial systems that embrace modern lives by being more accessible and transparent.

This blog talks about India’s modern financial technology ecosystem, while also explaining why it is expanding rapidly and the top startups leading this transformation.

The rise of fintech startups in India isn’t just a tech story — it’s a story of nationwide transformation. Over the past decade, these startups have redefined how Indians interact with money, moving beyond city limits to reach semi-urban and rural regions. From tier-2 towns as well as small and medium enterprises to daily wage laborers in far off villages, fintech innovation is bridging historic monetary divides. What started as a wave of disruption is turning out to be India’s next international success show— one where inclusivity, speed and easy finance becomes the new standard.

India’s fintech industry has expanded at a high rate, driven by rising digital acceptance and a huge unbanked base looking for more intelligent financial services. According to a report by ICICI Direct, the payment transaction is expected to reach $100 trillion in transaction value and $50 billion in terms of revenue by 2030

India’s fintech sector is currently worth $110 billion (2024) and is expected to grow at a CAGR of 31% to about $420 billion by 2029, as per Ajay Kumar Choudhary, Non-Executive Chairman and Independent Director, National Payments Corporation of India (NPCI). The surge in digital payments has fastened this growth, turning fintech into a need rather than an amenity for daily life.

The sudden surge in smartphone use along with some of the cheapest data plans has been a game-changer for fintech in India. Overnight, millions had the internet in their pockets and with that came easy access to digital financial services. The government’s “Digital India” push accelerated this trend further, setting the stage for a digital-first economy.

Additionaly, the new generation wanted speed, simplicity, and control, thus becoming the ideal customer base for mobile-first, user-oriented financial products. This amalgamation of quick commerce, access to technology, policy impetus, and demographic pull created the best possible environment for fintech growth.

The Indian government along with the Reserve Bank of India (RBI) played a significant role in supporting the development of the fintech ecosystem. Through Jan Dhan Yojana the government successfully integrated millions of people into formal banking use while Aadhaar-based verification streamlined new customer processes. UPI launched as a transformative real-time payment system that introduced immediate seamless financial transactions to become an everyday convenience.

The RBI maintains an innovative-friendly atmosphere through its experimental and regulatory sandboxes that show an important component of its forward-thinking development. Fintech startups benefit from the inclusive framework of infrastructure and policy guidelines and regulatory oversight which enables them to create safe and growing platforms.

BharatPe has become one of the most effective fintech startups by dealing with the specific challenges of India’s small and medium enterprises. Its path-breaking strategy of consolidating payment solutions with lending and investment products has served to bridge a great gap in the market, especially for those businesses that were left out of the mainstream financial services earlier.

By streamlining intricate processes and providing customized services to suit the requirements of small merchants, BharatPe is facilitating the adoption of digital finance, promoting financial inclusion, and empowering the economy’s backbone in India.

Through Slice young Indians now manage credit in a modern way which suits the digital preferences of its users. The startup provides credit cards with no annual fees and flexible payment options for potential customers without established credit records and who aim to develop their future financial prospects.

The user-friendly aspect of Slice’s credit experience platform drives younger consumers to use its services as it demonstrates a neo-banking trend that caters to Gen Z and millennial consumers. The product combination of convenience and transparency together with flexible payment options enables Slice to expand credit accessibility and transform financial services for Indian youth.

With its innovative approach CRED changes traditional credit card usage since bill payments now generate rewarding outcomes. CRED promotes responsible financial conduct through exclusive reward programs that give users access to benefits as a response to their prompt payments.

The true uniqueness of CRED comes from its successful attraction of high-value customers possessing good credit scores who seek premium rewards through their interactions. CRED established itself as a lifestyle brand and now provides both financial services and a comprehensive financial lifestyle experience thus becoming a top choice among Indian fintech platforms.

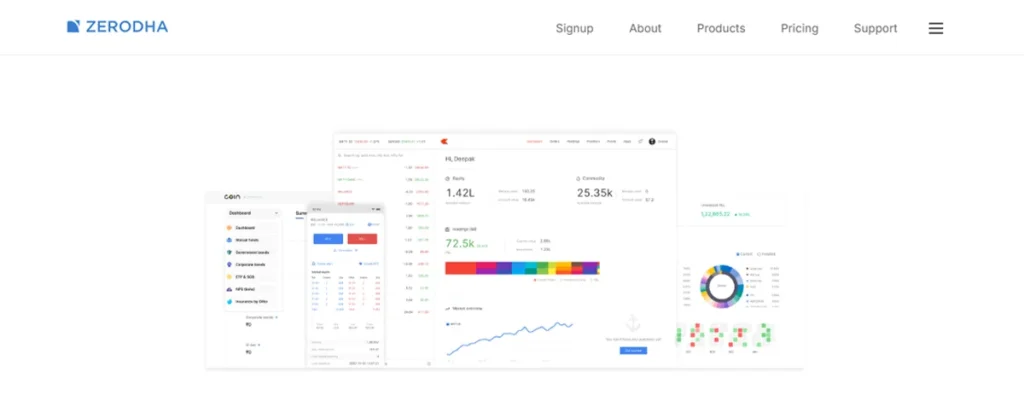

Zerodha has changed India’s stock market environment by lowering entry barriers for retail investors. By removing commission charges and providing a set of learning materials, Zerodha has made stock market investing available to the masses. The transparency, ease, and investor education offered by the platform have caused retail investing in India to soar in recent times.

Zerodha’s business model has not only changed the stockbroking sector but also enabled a new generation of investors to own their financial destiny. Through its dynamic methodology and emphasis on cost-effectiveness, Zerodha has established itself as a pivotal player in the fintech space in India.

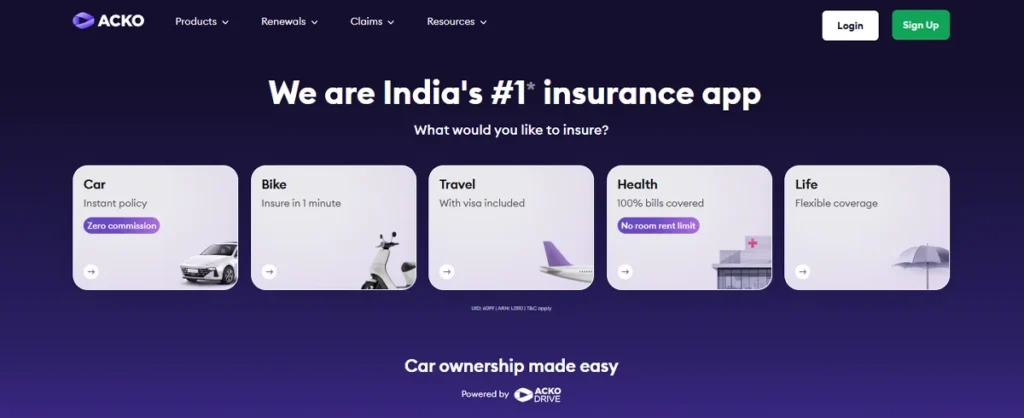

Acko has become a disruptor in India’s insurance market by changing the way insurance is purchased, sold, and serviced. Acko focuses on simplicity and speed and targets a new generation of customers who value fast, paperless experiences. Acko’s direct-to-consumer business model and robust tech foundation allow it to underwrite and settle claims with unprecedented efficiency.

>Through collaborations with platforms such as Amazon and Ola, Acko also provides contextual insurance—products that are natively embedded within customers’ day-to-day transactions. This innovation-first approach positions Acko as a leader, challenging the confines of what insurance can be in a digital-first economy.

Innovation-based companies take technology as their core element of development. Their product offerings integrate AI-based credit scoring technology and real-time payment solutions which focus on scalability alongside security outlooks and superior user experience.

Being able to understand the changing needs of the Indian consumer has been the most important. Whether it is rewarding credit discipline, bringing investments within reach, or facilitating cashless payments for kirana shops, these startups are addressing actual problems with customer-centric solutions.

The fintech industry is extremely dynamic, and these companies have demonstrated a remarkable capacity to pivot, innovate, and adapt to shifting regulatory environments while sustaining high growth.

Fintech companies are a key driving force behind India’s financial inclusion and digital-first economy journey. With innovative, inclusive, and low-cost financial solutions, they are not only transforming the financial services market but also serving to drive economic development.

As India keeps on adopting digitalization, the future of fintech is bright. With emerging technologies such as AI, blockchain, and open banking in the pipeline, these startups are poised to drive the next generation of financial innovation, simplifying finance, making it smarter, and more inclusive for all.

Sign up to receive our newsletter featuring the latest tech trends, in-depth articles, and exclusive insights. Stay ahead of the curve!