Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

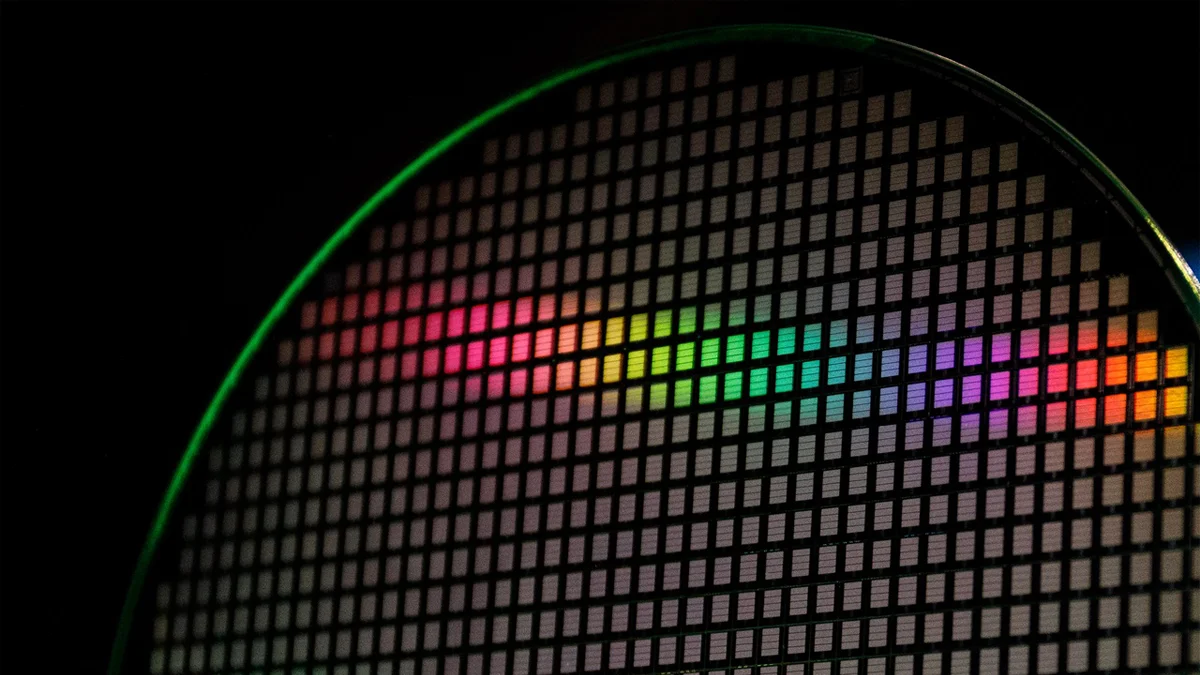

The US government has finalized the rules required to facilitate a 25% tax credit for projects that involve manufacturing of semiconductors. With the rules in place, the US can extend tax credits to many chip companies under the 2022 Chips and Science Act.

According to Yahoo Finance, the Chips Act is aimed at revitalizing the US semiconductor industry following decades of external production. Last week, Wolfspeed announced that it would be receiving $1.5 billion in Chips Act funding to boost its operations. It allocates $39 billion in grant financing and $75 billion for loans and loan guarantees.

The new semiconductor tax credit rules will facilitate implementation of the US Chips Act. Tax refunds are among the three main subsidy streams provided for in the Act. Grant funding and loans and loan guarantees have captured the attention of chip manufacturers across the US.

However, tax credits promise to have an even bigger impact on manufacturers. With Chip Act funding covering between 10% and 15% of project costs, tax credits are a game changer because they enable manufacturers to retain up to 25% of chargeable tax.

“Our goal is to give you the minimum amount of money necessary to get you to expand on our shores in a way that advances our economic and national security objectives. That means looking at all sources of funding and then figuring out how our funds get you over that hump,” Mike Schmidt, Director at the Commerce Department, Chips Office said.

Different US companies will benefit from the chip tax credit. These include manufacturers of chip making equipment and semiconductors. The US will extend semiconductor tax credits to chips and solar wafers manufacturers.

The solar wafer makers tax is aimed at spurring domestic production of solar panel components. The US has been struggling to boost production of these components locally despite increased investment in solar panel manufacturing companies. But the solar tax credits will not benefit the entire solar supply chain. Companies that produce materials like polysilicon that’s needed to make wafers will not enjoy tax cuts.

In recent years, chip manufacturers have said they’d be making investments amounting to more than $400 billion in the US. These manufacturers include leaders in the semiconductor industry like Intel Corporation and Taiwan Semiconductor Manufacturing Company. In March 2024, Intel announced a $100 billion investment to expand its US chip making capabilities and capacity.

Currently, the US is experiencing a surge in chip and semiconductor production. This means that the government may have to invest more in the Chips Act than initially planned. Originally, the Congressional Budget Office projected that tax credits would amount to $24 billion. However, based on current investment trends, experts forecast that foregone revenue could hit the $85 billion mark. This represents an 80% budget overrun.

In most instances, the tax credits extended by the US government will account for the highest share of incentives that any company receives under the Chips Act. For instance, Micron Technology expects to receive $11.3 billion in tax cuts for two chip plants in New York. This is more than the $6.1billion the company seeks to receive in grants and $7.5billion that it is seeking in loans to support the two plants and a third one in Idaho.