Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

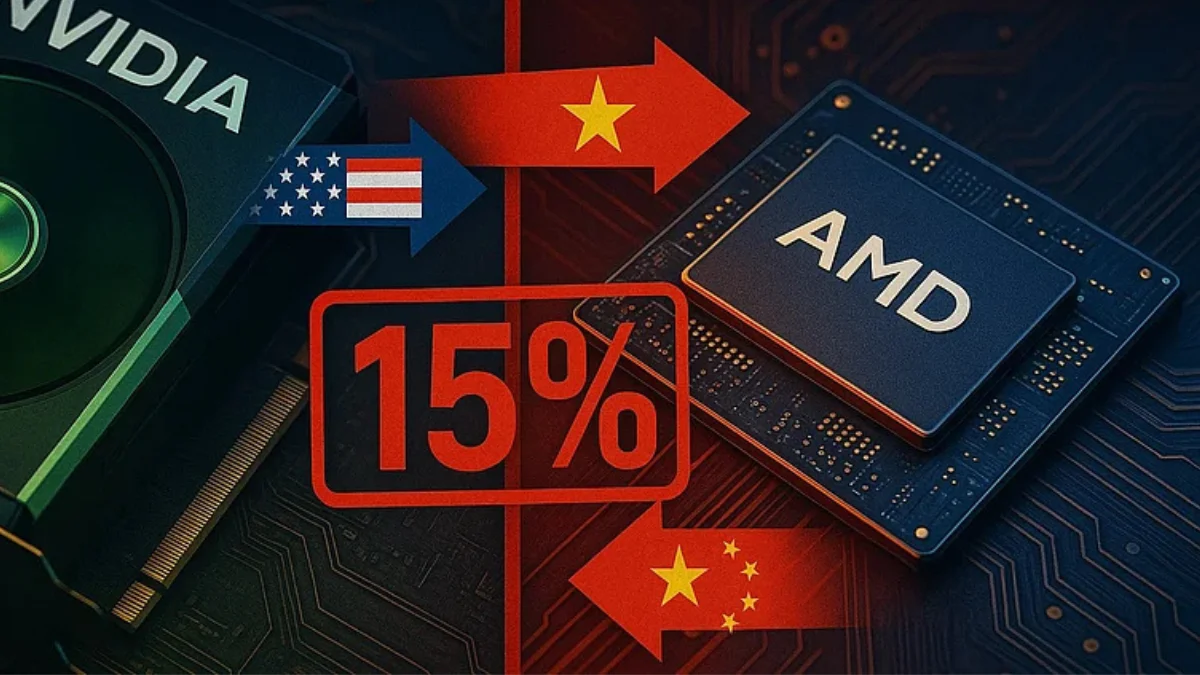

The US government has introduced a new policy that will see chipmakers Nvidia and AMD share 15% of their revenue share from China-related chip sales with the government, as per Reuters. This marks a major shift in how high-tech exports are regulated and is tied to new export license conditions. The arrangement is part of an evolving semiconductor deal in US-China trade relations, aimed at balancing economic interests with national security concerns.

Under the agreement, Nvidia and AMD will be required to hand over a portion of their sales earnings from certain high-performance chips sold to Chinese clients. Nvidia and AMD’s 15% revenue share to the US clause applies mainly to the companies’ advanced AI processors, such as Nvidia’s H20 and AMD’s MI308.

This move means that a part of Nvidia’s revenue share from the Chinese market will now be redirected to the US Treasury. Similarly, AMD will see its China-based earnings impacted. This is expected to influence how both companies price and market their AI chips in the region.

The 15% levy is not just a tax but a condition for the export license for chip sales in China. In simple terms, if these companies want to continue selling their modified AI chips in China, they must agree to this revenue-sharing arrangement. The policy is seen as a middle-ground solution, allowing the US to maintain some control over advanced semiconductor technology while avoiding a full ban on sales.

Industry analysts believe this will reshape the competitive landscape. Some see it as a way for the US to indirectly benefit from the lucrative Chinese AI market, while others view it as a move that could push Chinese tech companies to accelerate domestic chip development.

The deal centers on H20 MI308 chips’ revenue, which could bring in billions from sales. China is one of Nvidia’s biggest markets for AI chips, and the revenue share requirement may trim its profits. Even so, the company considers it a better trade-off than being shut out of China completely by stricter export rules. Nvidia warned inability to supply H20 could slice $8 billion off sales for its July quarter; AMD forecast a $1.5 billion hit to revenue.

AMD faces similar challenges. While the MI308 chip has been tailored to comply with US restrictions, the revenue-sharing rule means the company will need to re-evaluate its pricing and supply strategies for Chinese clients.

This new semiconductor deal in US-China relations highlights how critical the AI chip sector has become in global politics. By tying market access to revenue-sharing, the US is creating a precedent that could apply to other industries and regions in the future.

For now, both companies appear willing to comply, as losing access to China’s massive AI hardware market would be a far greater setback. However, with Beijing likely to respond, the policy could spark new rounds of negotiation—and possibly more trade friction—between the world’s two largest economies.