Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

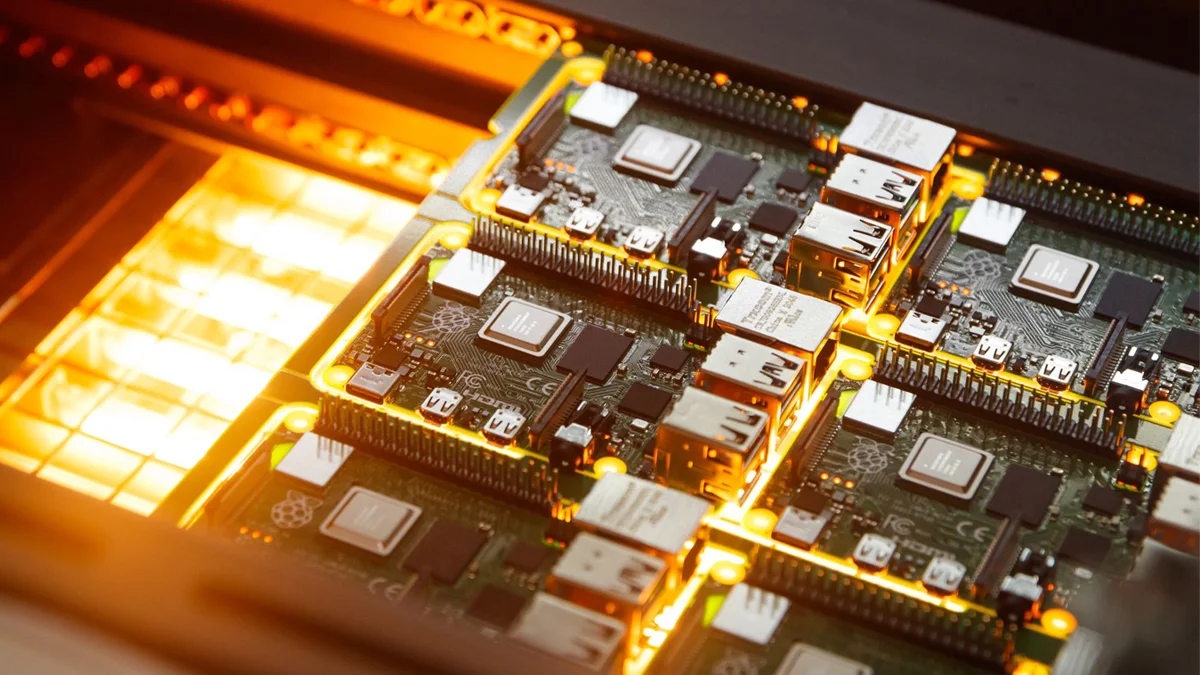

Stocks of UK-based computer manufacturer Raspberry Pi Holding rose 7.5% after the company released its first full year financial results since its IPO last year. Raspberry Pi’s profit report showed 2% dip in revenue and a 57% profit decline, Reuters reported.

Despite this, the single-board computer manufacturer expressed optimism saying it expects demand for its products to build-up steadily throughout 2025.

Raspberry Pi financial results showed that the company narrowly surpassed earnings expectations. Revenues were boosted by sales in the company’s semiconductor units and its flagship product, Raspberry Pi5.

The semiconductor maker went public in June 2024 in London. It manufactures low-cost accessories, microcontrollers, and SBCs that are used in robotics and automated systems, smart-home systems, and video game emulators. The company will be launching its largest number of new products this year. These include its debut AI hardware in partnership with Sony and Hailo.

During the earnings call, the company said 2024 was shaped by the IPO as well as a revival of its platforms that included increasing production of Raspberry Pi5.

“There was always that risk that people think you’re going to turn evil once you’re listed. But getting interesting new products out at our price points was useful for that,” Raspberry Chief Executive Eben Upton said.

Raspberry’s annual sales revenues for 2024 stood at $259.5 million. This was 2% less than the previous years. The company said that it sold 5% less semiconductor units in the year, which amounted to about 7 million units. The company launched 22 products in 2024 and enlisted 13% more resellers in the year.

In 2024, Raspberry’s profit before tax amounted to $16.3 million compared to $38.2 the previous year. The company attributed the dip in profitability to higher admin costs, research and development costs, depreciation, and amortisation. The company closed the year with a net cash of $45.8 million after raising $40 million through an initial public offering.

“With channel inventory now normalised, Raspberry Pi anticipates a steady build-up in demand throughout the year, positioning us strongly despite ongoing macroeconomic and geopolitical uncertainties. The projected pace of market recovery, coupled with the timing of embedded design wins, strengthens confidence in solid and sustainable sales growth in full-year 2025,” the company said during the earnings call.

Raspberry IPO was priced at 280 pence. It generated £166 million of proceeds, which included £31 million in new capital. The company was valued at £541 million on debut.

Raspberry sold about 1.9 million units of its Raspberry Pi5s in 2024 with 16 GB units costing about $148 in the UK. Following the company’s earnings report, the price of its stocks rose significantly, from 280 pence during the IPO to 500 pence. Upton says his company’s technology allows manufacturers to integrate powerful computing power into their products at a much lower cost.

The company CEO highlighted examples of businesses that are already using its technology to track concrete curing and delivery in construction sites. The company is concerned about the impact that US tariffs could have on its products. According to Upton, any tariffs will make its products costly for US buyers. He was however quick to note that no competitor is in a position to exploit these price changes.

“If an American OEM (original equipment manufacturer) were to choose to make rather than buy, then many of the components that they would use to make would also be subject to tariffs,” Upton said.

Last year alone, 25% of Raspberry Pi5 sales were made in the American market.