Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

In Focus

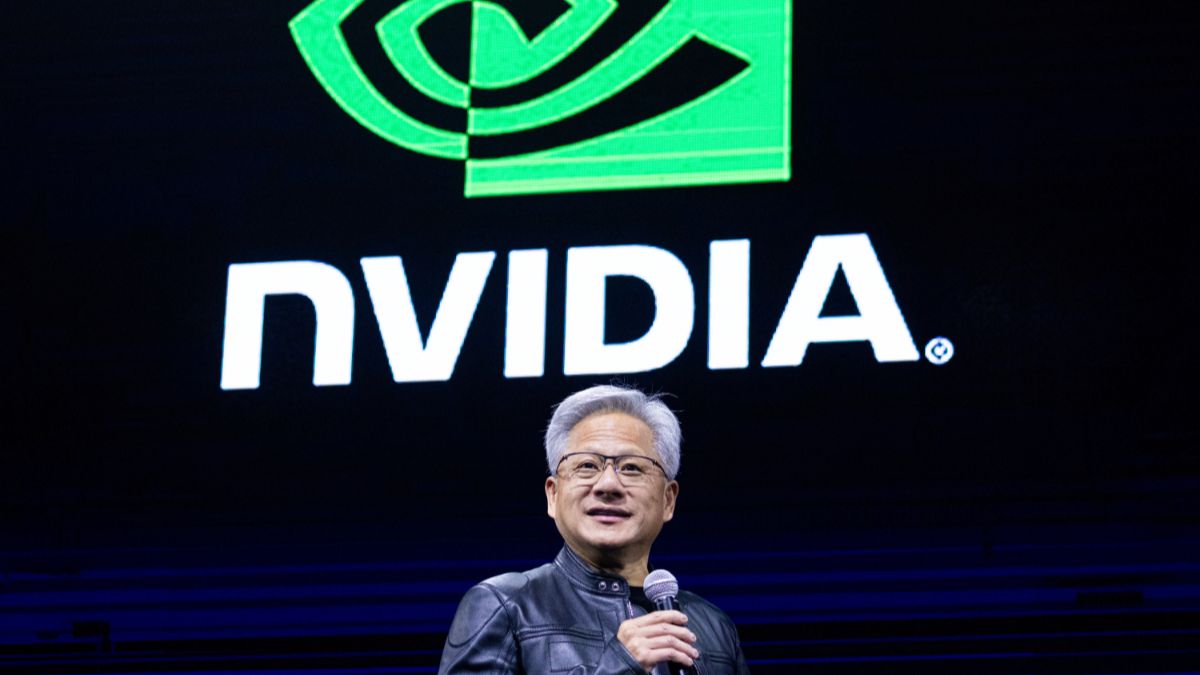

NVIDIA stock surged 4% on October 29, 2025, pushing the tech giant’s market valuation past the $5 trillion mark. According to CNBC, NVIDIA’s $5 trillion valuation marks a major milestone for the AI chip manufacturing company.

NVIDIA has grown from a video game processor to a top player in the AI boom. This year alone, its stock has gained 50%.

On October 28, 2025, AI trade pushed U.S. stocks to new highs with market valuations for Microsoft and Apple passing the $4 trillion market.

The latest market valuation milestones comes soon after CEO Jensen Huang announced that the chipmaker will build AI supercomputers for the U.S. Department of Energy (DOE). Huang said that the company expects $500 billion in orders as demand for Nvidia AI chips surges.

Propelled by the AI boom, NVIDIA shares have risen 12-fold since ChatGPT launched in 2022.

With the latest milestone, the chipmaker’s valuation surpasses that of the entire crypto market. NVIDIA’s AI rally valuation is now equivalent to 50% of Europe’s Stoxx 600 index.

“Nvidia hitting a $5 trillion market cap is more than a milestone; it’s a statement, as NVIDIA has gone from chip maker to industry creator,” Senior Equity Analyst at Hargreaves Lansdown, Matt Britzman said.

NVIDIA valuation milestone 2025 comes as tech companies rush to build the AI infrastructure needed to train and run AI models. In September 2025, Oracle and SoftBank partnered with OpenAI to build five new Stargate data centers in the U.S.

A Quick Preview of NVIDIA’s $5 Trillion Valuation

Analysts have warned that NVIDIA’s H20 chips market share in China could shrink due to regulatory scrutiny and emerging competition. Chip export ban on the sale of the advanced chips has escalated tension between the U.S. and China.

In May 2025, Huang argued that AI chip curbs were hurting American companies more than Chinese companies. Analysts also warned that the export ban could give China a chance to catch up with American AI chip technology rather than protect its dominance.

U.S. President Donald Trump is expected to discuss NVIDIA’s Blackwell chips with Chinese President Xi Jinping on October 30, 2025.

In recent months, rallying tech valuations have ignited debate about a possible AI bubble. The Bank of England and the International Monetary Fund warned that global stock markets could suffer should investor enthusiasm for AI fade. Ark Invest dismissed fears of an AI bubble but held that AI stocks could soon encounter short-term correction.