Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

Nvidia notched Apple’s market capitalization on Monday, October 14, 2024, after its stocks closed at a record $138.07. With a 2.4% share surge, Nvidia moved closer to becoming the most valuable company in the world.

CNBC reported that Nvidia shares have gained close to 180% this year with investors betting on strong demand for the company’s Blackwell AI chips.

Nvidia had clinged the world’s most valuable company in June 2024. However, its reign was cut short by Microsoft after its market valuation overtook Nvidia’s. Since then, the market capitalization for the three companies- Nvidia, Apple, and Microsoft- have been close for months.

The latest share surge pushed Nvidia’s market capitalization to $3.39 trillion. This places the chip manufacturer above Microsoft’s $3.12 trillion, but slightly below Apple’s $3.52 trillion. Nvidia is considered Wall Street’s largest winner in the big tech AI race

“We believe the major companies in AI face an investment environment characterized by a Prisoner’s Dilemma. Each is individually incentivized to continue spending, as the costs of not doing so are potentially devastating,” Analyst TD Cowen said in a Sunday report.

In August 2024, Nvidia confirmed that production of Blackwell AI chips had been delayed until quarter four. At the time, the company downplayed the impact the delay would have on demand for these chips.

But Nvidia CEO, Jensen Huang confirmed that production is now on course and going as planned earlier this month. He also said that Blackwell AI chip demand is insane despite production delays.

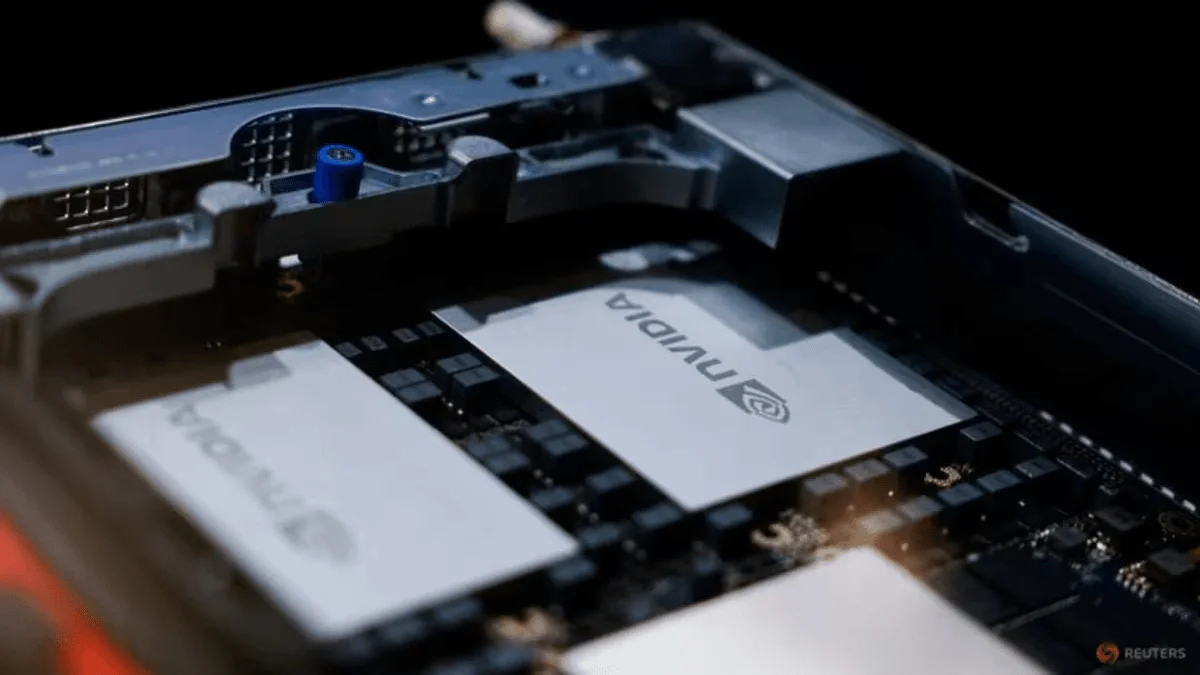

Nvidia is seen as the largest beneficiary in the generative AI boom. The AI boom started soon after OpenAI released ChatGPT in 2022. Nvidia-manufactured graphic processing units are used to develop and deploy advanced AI models that power applications such as ChatGPT. Nvidia’s AI chip impact is evidenced by its list of customers who include big tech giants like Google, Meta, Microsoft, and Amazon.

These, and other companies have placed massive orders of Nvidia GPUs to develop huge computer clusters for their advanced AI models. Out of the billions that leading tech companies spend to build AI each year, a significant percentage goes to Nvidia. Currently, the company controls close to 95% of the AI inference and training chip market.

But the company is facing stiff competition from other chip manufacturers like AMD, the second largest AI chip maker.

On October 10, 2024, AMD unveiled an AI chip called Instinct MI325X to take on Nvidia’s Blackwell AI chip. Nvidia’s sales revenue has increased by more than double each quarter for the past five quarters. Analysts expect a modest slowdown over the next quarter as they project revenues of about $32.9 billion in the current quarter.

The Nvidia stock surge happened at a time when Wall Street is preparing for updates on earnings and AI infrastructure spending plans from tech giants. Nvidia, Apple, and Microsoft account for a fifth of the S&P 500 index.

This means they have a huge impact on the index’s gains and losses every day. As the quarterly reporting season approaches, Apple stocks gained 2% while Microsoft shares gained by 0.7%. These gains propelled the S&P 500 to close at a record 0.8% high.