Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

Nvidia stock performance surged 6% in market trading on May 29 after the AI manufacturer posted positive earnings, CNBC reported. Nvidia defied US AI chip export curbs to post better-than-expected earnings and revenue that triggered a global chip stocks rally.

Nvidia revenue earnings of $44.1 billion for the quarter under review, surpassing analysts projects on $43.3 billion. In the same period last year, the AI chip maker had reported $26 billion in earnings. The company announced adjusted earnings per share of $0.96, which is slightly higher than analysts’ $0.93 estimates.

These earnings were also significantly higher than the $0.61 that the company announced last year. Although Nvidia’s overall revenue exceeded analyst expectations, the company reported a slight drop in its data center revenue. For the quarter under review, the chip giant reported $39.1 billion against analyst expectations of $39.2 billion. However, the revenues were significantly higher than last year’s $22.5 billion.

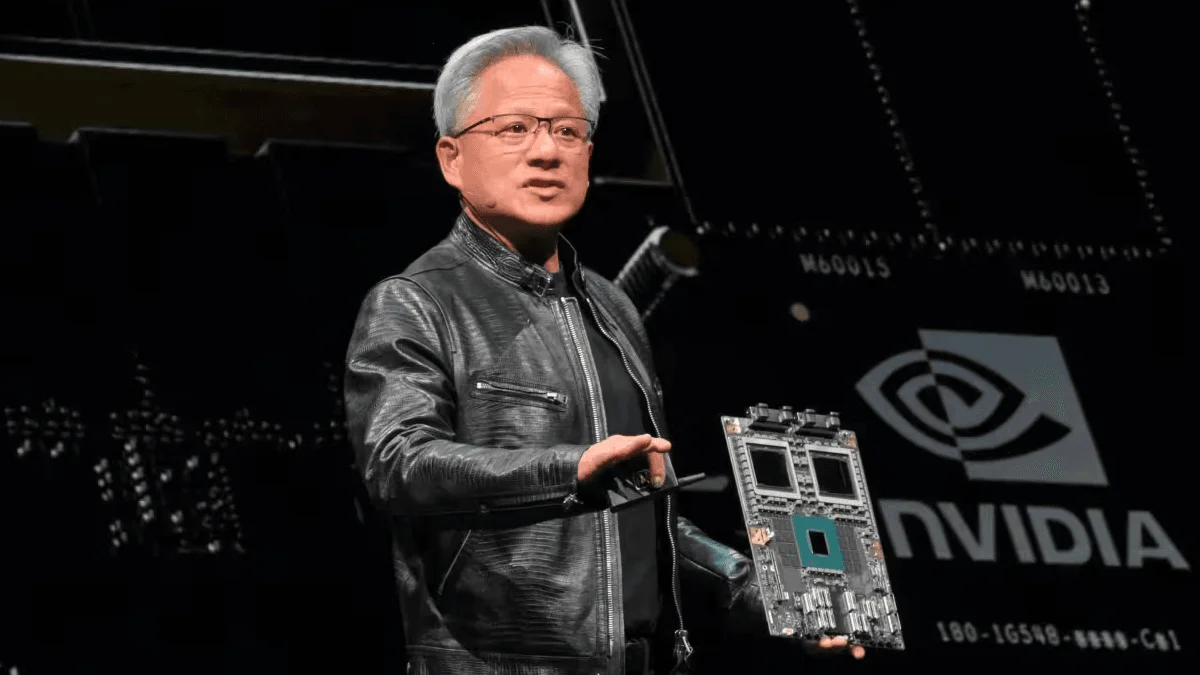

Nvidia was quick to associate an $8 billion revenue drop to the chip export control rules introduced by the US government in quarter two to restrict exportation of H20 chips to China. Last week, CEO Jensen Huang indicated that the chip manufacturer had lost sales worth $15 billion due to the restrictions.

“The $50 billion China market is effectively closed to US industry. The H20 export ban ended our Hopper data center business in China. We cannot reduce Hopper further to comply. We are exploring limited ways to compete, but Hopper is no longer an option,” Huang continued. “China’s AI moves on with or without US chips,” Huang said in an interview.

Investors view Nvidia’s performance as an indicator of the wider chip industry and AI related stocks. The chip manufacturer’s latest earnings have sparked interest in global chip stocks. In Europe, stocks of leading semiconductor makers like ASML, BE Semiconductor, and ASM International surged.

Stocks of Japan’s Tokyo Electron recorded a 4% rise while those of SK Hyix closed 2% higher in South Korea. SK Hynix is Nvidia’s high bandwidth memory supplier. Nvidia’s stock uptrend also improved the performance of US-based companies like Marvell, which gained 7%, and Qualcomm. The AI chip industry has been facing uncertainty due to US tariffs and export restrictions.

Tech companies like ASML lost billions in stock value following the global stock sell-off triggered by US tariffs. On April 3, sweeping tariffs announced by President Donald Trump caused turmoil in the global stock market as they rippled through early market trading. ASML manufactures important components that are required to make advanced chips.

During the May 28 earnings call, Nvidia reported that it had written off $4.5 billion in H20 chip stock that it could not ship to China after US export restriction rules took effect. According to the company, the chip curbs also cost it an additional $2.5 billion in lost revenue.

But the US government appears not to be changing its mind about restricting chip exportation to China. Already, the government has instructed selected companies to stop exporting products to the Chinese market unless they are licensed to do so. Some of the firms that have received such instructions include those that design software and manufacture chemicals for semiconductors.

Nvidia’s ability to overcome these barriers and post positive results demystifies fears that demand for AI chips may be waning. The chips have become important components of training massive AI models. Nvidia is now a symbol of the AI boom that started in late 2022. The company’s latest earnings were largely driven by investments from US big techs like Amazon, Meta, and Microsoft.