Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

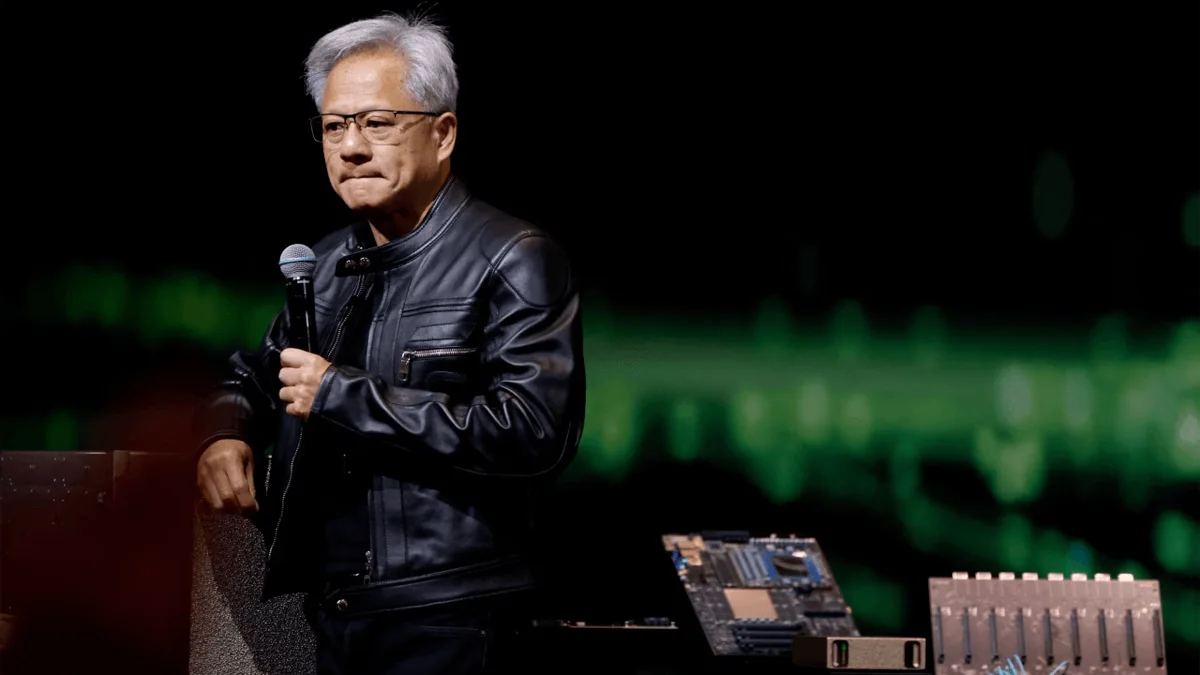

Nvidia CEO Jensen Huang says chip curbs have caused more harm to US companies than to China, CNBC reported. Analysts have also warned that the US chip export policy could give China a chance to catch up with American AI chip technology, rather than protect its dominance of the global artificial intelligence industry.

During the yearly Computex technology trade show in Taipei, Huang spoke about chip export controls and their impact on Nvidia. The tech mogul said that in the last four years, his company’s chip market share in China has dropped to 50% from 95%.

The US has been rolling out chip export restrictions for over a year now. American chip designers have opposed chip export controls for a long time. Their biggest fear has been the loss of lucrative deals in China. Experts in the chip industry say the curbs are hurting American AI chip developers.

“The effects of the controls are twofold. They have the impact of reducing the ability of U.S. companies to access the China market and, in turn, have accelerated the efforts of the domestic industry to pursue greater innovation. You create competitors to your leading companies at the same time you’re cutting them off from a massive market in China,” DGA Group Partner and Senior VP for China Paul Triolo said.

The main goal of curbing chip exports is to ensure that China does not leverage American AI technology to advance its military. Although the US may have succeeded in doing this on paper, analysts argue that AI chip stockpiles in China and existing loopholes have complicated the situation.

“That’s partly why we are seeing a closing of the gap between Chinese and US AI capabilities,” Tech and Chip Analyst Ray Wang said.

Earlier this month, US tech think tank, Information Technology & Innovation Foundation said the export controls introduced by the Biden administration failed. Despite this fact, the US government has doubled down on the restrictions.

“While the U.S. government is certainly right to prevent US companies from selling advanced AI technology to the Chinese military, cutting US companies off from the entire commercial Chinese market is a cure worse than the disease. US export controls have cost Nvidia at least $15 billion in sales, and those are revenues the company needs to be able to earn to invest in future generations of innovation,” Stephen Ezell of Information Technology & Innovation Foundation said in an email statement.

For many AI chip developers, inconsistencies in AI chip restriction rules by the US government over the years present additional challenges. For instance, Nvidia designed H20 chips to comply with the restrictions that existed before the export rules announced recently. Last month, the AI chip maker said it will lose $5.5 billion in revenue as a result of the new controls that restrict the sale of H20 chips.

“We are not just talking about one export control, we are talking about a series of export controls that originate from all the way back in 2019,” Wang added.

According to Trilio, the purpose of the chip restrictions has also changed, leading to confusion and damage.

“The continued expansion of the controls, and the lack of an articulation of what the clear end game here is, has really created a lot of issues, and created a lot of collateral damage,” Triolo said.

The US is executing chip export controls at a time when Beijing has mobilized billions of dollars as part of its chip localization strategy. Analysts and experts say the export control will likely spur development of alternative semiconductors in China. Already, Huawei has developed Ascend AI chips.

“The bottom line is, the controls have incentivized China to become self-sufficient across these supply chains in a way they never would have contemplated before,” Triolo added.

In light of Chinese achievements like Huawei’s Ascend chips and DeepSeek’s R1 model, Experts continue to question the success of US chip export restrictions.