Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

AI chips produced by Nvidia have paved the way for huge investments to flow into AI startups from venture capital firms, Yahoo Finance has reported. According to data from PitchBook, Nvidia venture capital influence attracted more than $306.5 billion in machine learning and AI startups. Out of this amount, $230 billion has been invested in Nvidia AI startups within the US.

Companies in the AI industry accounted for about 48% of the total venture capital investments in the country. Globally, investments from venture capitalists into the AI and machine learning industry hit the $76.5 billion mark in quarter one of 2025. This amount accounted for more than 70% of the total deals by venture capitalists signed in this period. Most of these investments, $66 billion, went to US-based AI enterprises.

PitchBook says Nvidia’s role in AI startup growth has been pivotal. The US tech giant has provided the compute backbone that the industry needed to thrive.

“ChatGPT’s breakout showed that large language models could scale into real products, which sparked a sharp rise in investor appetite. Nvidia played a central role by supplying the compute backbone,” PitchBook AI Analyst Dimitri Zabelin said.

AI has been in existence for decades now. However, researchers started experiments to power the technology with Nvidia chips in the early 2000s. These experiments proved Nvidia chips as more effective compared to the conventional central processing units.

The popularity of AI semiconductors increased significantly after AI computing models powered by Nvidia chips captured the attention of Silicon Valley innovators and academicians in 2011 and 2012. However, Nvidia AI chip demand did not grow until 2022 when Sam Altman’s OpenAI unveiled ChatGPT. Since its launch, the chatbot has played a big role in mainstreaming AI across the globe.

Since the launch of ChatGPT, Nvidia shares have gained 670% in value compared to other S&P 500 stocks that have recorded a modest 42% surge. This stock performance has largely been driven by the rising demand for AI chips.

“As GPU demand surged, it reinforced the view that AI represents a durable investment cycle. That in turn set off a flywheel of product-market fit, infrastructure buildout, and accelerating capital flows,” Zabelin added.

Bloomberg estimates show that big techs like Meta and Microsoft might spend 25% and 47% of their capital costs respectively on Nvidia chips. Additionally, Nvidia will be reporting its quarterly earnings on May 28. The chip manufacturer is expected to report increased revenue for the April quarter.

Wall Street analysts estimate that Nvidia’s revenue for this quarter will surge by more than 66% to reach the $43 billion mark. They also expect a 44% rise in earnings per share to a $0.88 high. According to Bloomberg, shares of the company could surge or plunge by up to 7% depending on its quarterly performance.

As Nvidia releases its earnings, investors will be eager to know how the US chip export controls have affected the company. Some analysts have said that China will be the biggest swing factor in the quarter under review.

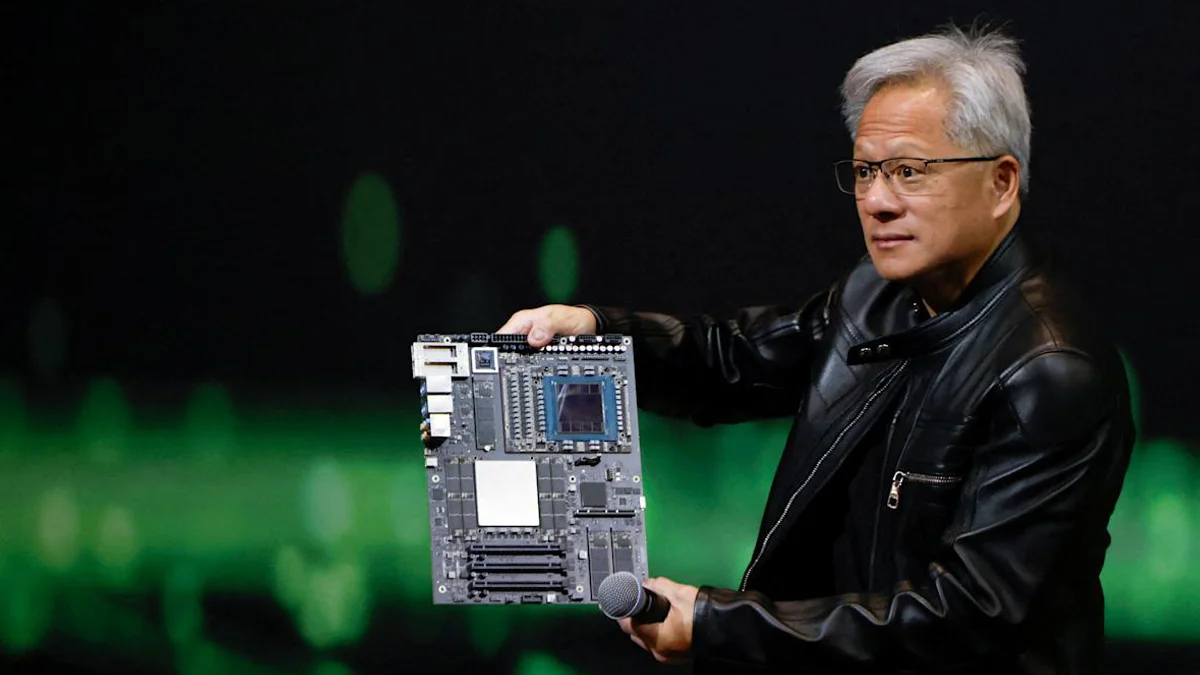

Last month, the Trump administration capped exportation of Nvidia H20 chips to China. This move saw the chip maker announce a $5.5 billion charge in lost revenue. Last week, Nvidia CEO Jensen Huang said the company had lost $15 billion in sales following China export curbs. The company had estimated that the Chinese AI chip market could reach the $50 billion mark in 2026. Last year, sales from H20 chips in China accounted for 13% of Nvidia’s total revenue.

“The primary question around results and guidance is can Nvidia lift sales enough to offset the loss of H20 or China business,” Wedbush analysts said.

While Nvidia plans to introduce a new Blackwell AI chip for the Chinese market, the uncertainty surrounding the loss of business in the Asian country has had a negative impact on its stock.