Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

NVIDIA’s share price could rise further after its valuation surpassed that of Apple and Microsoft on July 9, Yahoo Finance reported. With a $4 trillion market cap, Nvidia became the first publicly traded firm to reach this market value.

Nvidia chips include the CUDA software platform and modified graphics cards that are designed to run AI programs and train AI models. These capabilities give the chip manufacturer a strategic advantage that its rivals, Intel and AMD, are struggling to overcome.

US tech giants like Meta, Google, Amazon and Tesla are among Nvidia’s biggest customers. These companies continue to spend billions of dollars on the company’s hardware as they develop AI models and establish the data centers they need to provide cloud-based services to their clients.

Nvidia chips are not just riding the AI model training and inference front. Their popularity has also been driven by the growth of AI sovereignty as countries seek to use their own AI services as opposed to relying on those abroad. As sovereign AI gains traction, Nvidia is looking to supply hundreds of thousands of AI chips to a range of countries, including many in Europe and the Middle East like Saudi Arabia.

On Wednesday, July 9, Nvidia stocks gained 2%. The US chip giant continues to ride the generative AI boom that started in 2022 following the launch of OpenAI’s ChatGPT. However, the value of Nvidia stocks has risen by around 21% this year alone despite experiencing highs and lows early in the year. The stocks have gained 24% over the last one year.

Nvidia’s journey to surpassing Apple’s market cap has not been smooth. Its stocks have been on a roller coaster this year after the company’s market valuation dropped by $6oo million following the launch of DeepSeek’s R-1 model in January. At the time, the Chinese AI startup claimed that it could train its models for a far lower cost compared to advanced chips.

DeepSeek’s claims triggered a Wall Street meltdown as investors feared that Nvidia’s advanced data center chips would lose appeal. The other thing that triggered market fears had to do with the possible shift in the AI industry, from AI training to inferencing. These issues caused investors to believe AI chips produced by Nvidia would no longer be necessary.

However, Nvidia has managed to prove these concerns wrong. Its AI chips continue to reign in the AI industry as the best for training large language models. The industry has also proven their inferencing benefits from more powerful AI processors as they facilitate responses to more complicated queries.

Further, Nvidia managed to overcome the uncertainty resulting from US AI chip export restrictions to China. Both the Trump and Biden administrations have restricted the sale of American chips to the Asian country.

In April this year, Nvidia said it would face a $5.5 billion charge in its 2026 quarter one results. The tech giant said this after President Donald Trump capped exports of its H20 AI chips to China. The Asian economic giant has been one of Nvidia’s key markets for its popular semiconductors.

H20 is Nvidia’s most advanced chip available for export to China. It’s critical to the company’s efforts to remain engaged in the booming Chinese AI industry. The company also expects to write down up to $8 billion in the current quarter as a result of the export restrictions.

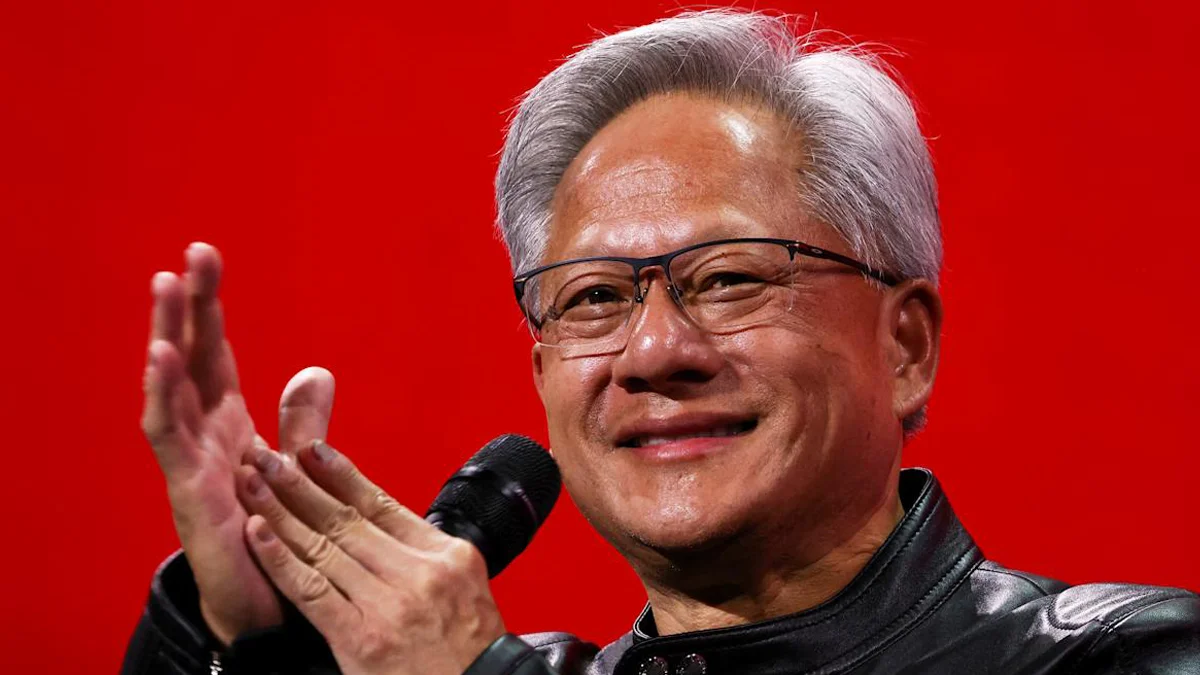

But despite these challenges, the stock prices of the chip giant continue to rise. In May this year, Nvidia CEO Jensen Huang said the chip curbs have caused more harm to US companies than to China. The US chip maker is set to unveil its latest Blackwell Ultra chip. The new chip could push Nvidia’s valuation further as its stock price rises.