Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

Intel is weighing the possibility of divesting two of its businesses, the edge computing unit and the network unit. According to Reuters, the US chip manufacturer is considering the Intel networking unit sale to drop sections that its new CEO does not see as important.

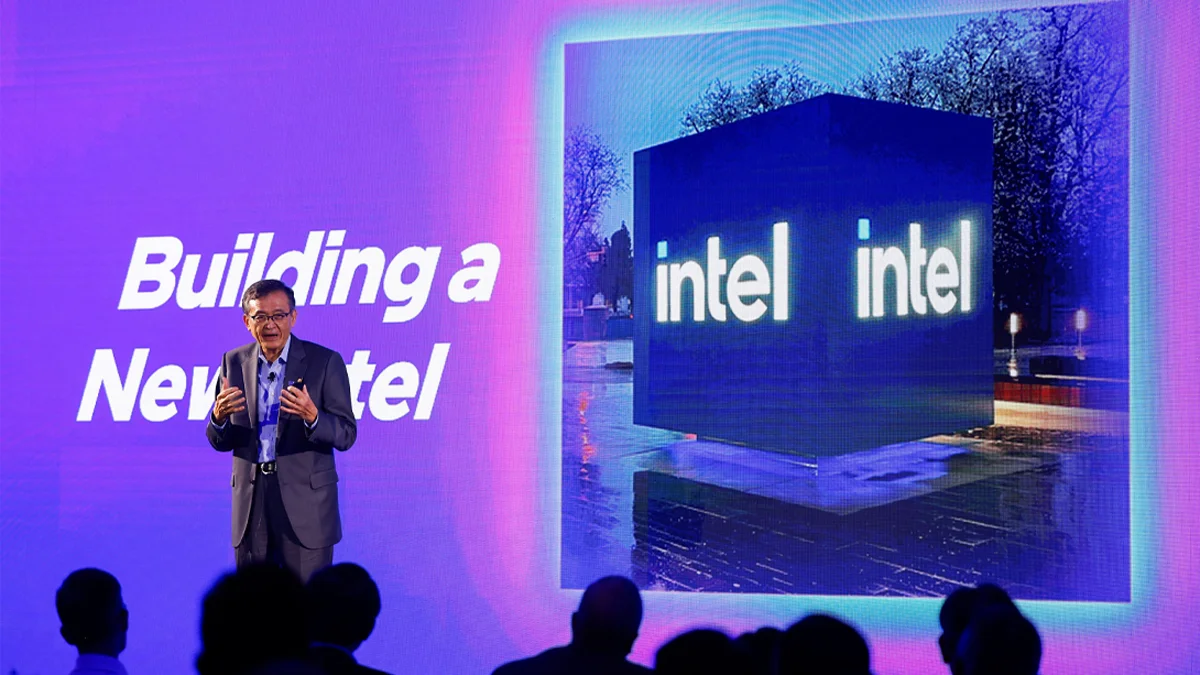

The Intel edge business sale is part of the broader turnaround strategy that CEO Lip-Bu Tan plans to use to refocus the company back to its historical core business, which is production of data center and PC chips. Intel once referred to the two businesses it wants to sell as the NEX group in its financial reports.

Speaking to executives in Taipei on May 19, Tan said the company will continue to expand and build on these units moving forward. According to the CEO, it makes sense to focus on chip manufacturing because Intel holds about 55% of the data center chip market and 68% of the PC market for the same.

Tan has been making big changes in Intel since his appointment as CEO earlier this year. These changes include a review of the company’s leadership structure to make leaders of data center and personal computer units report directly to him. The new CEO also introduced a new Chief of Technology and AI in the company.

Sources close to the company say that Intel is considering selling the units in the NEX group because they’re no longer relevant to the company’s new strategy. Intel’s edge computing and networking businesses manufacture chips for telecom companies. In Q1 of 2025, the company quit reporting financial performance of these businesses separately.

Instead, the company shifted financial results for the networking and edge business to its data center and personal computer groups. Intel views companies such as Broadcom as having a bigger share in important portions of the networking market. This aspect may have informed the decision to divest its networking business alongside the edge computing unit.

As it considers the Intel business restructuring process, the US PC chip manufacturer has already thought about how and when to exit the NEX units. According to sources who are familiar with the matter, the tech giant has already engaged entities that may be interested in the units. However, the company is yet to solicit bidders formally or initiate a formal deal.

In recent weeks, Intel has interviewed several investment bankers in recent weeks as it seeks an adviser to guide the sales process. The company is yet to engage a banker formally.

Intel has been exploring its business portfolio to see whether it would be more strategic to sell a portion of it or partner with another company. Discussions about the potential sale are still in the early stage within the company. Sources close to Intel said the company may opt to make other arrangements instead of selling its NEX businesses.

In 2024, revenue from Intel’s NEX group amounted to $5.8 billion. If Intel opts to sell-off its networking and edge businesses, it will not be the first time the company will be selling some of its units. Last month, Intel sold off a 51% stake in its Altera business for $4.46 billion. The company sold the stake to SilverLake to enable it finance its revival strategy. The deal pushed Altera’s valuation to $8.75 billion.

“Today’s announcement reflects our commitment to sharpening our focus, lowering our expense structure and strengthening our balance sheet. Altera continues to make progress repositioning its product portfolio to participate in the fastest growing and most profitable segments of the field programmable gate array market,” Tan said at the time of the Altera sale.

Prior to the Altera sale, Intel had been working towards spinning the unit off through a public off the way it did in 2022 with Mobileye. While CEO Tan’s turnaround strategy involves focusing Intel’s efforts to core operations that generate the highest revenue, the tech giant has lost significant market share in the chip market as competition intensifies.