Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

Intel will be reporting its net loss for the sixth consecutive time on July 24. The company is expected to report a drop in revenue for the fifth quarter. According to Reuters, shareholders will be keen to know what CEO Lip Bu-Tan’s plan for Intel’s contract manufacturing business is, as sales continue to drop and losses rise.

Analysts expect Intel’s Q2 net losses to amount to an estimated $1.25 billion. The company’s quarterly revenue is expected to drop by about 7% to $11.87 billion compared to $12.67 billion reported in Q1. However, Intel is expected to register a modest 2.5% annual revenue growth

The chip maker is expected to announce $0.01 in earnings per share, pointing to potential stabilization after previous losses. The company’s Q2 performance shows that the company is focused on stabilizing operations, capitalizing on emerging opportunities, and improving its market position even as competition persists.

Intel was once the leading chip manufacturing company in the US. However, the company has lagged due to years of strategic missteps. The company’s main rival, NVIDIA, has ridden the artificial intelligence wave to leap ahead in the chip industry. AMD, on the other hand, has acquired a share of Intel’s server semiconductor and personal computer market over the years.

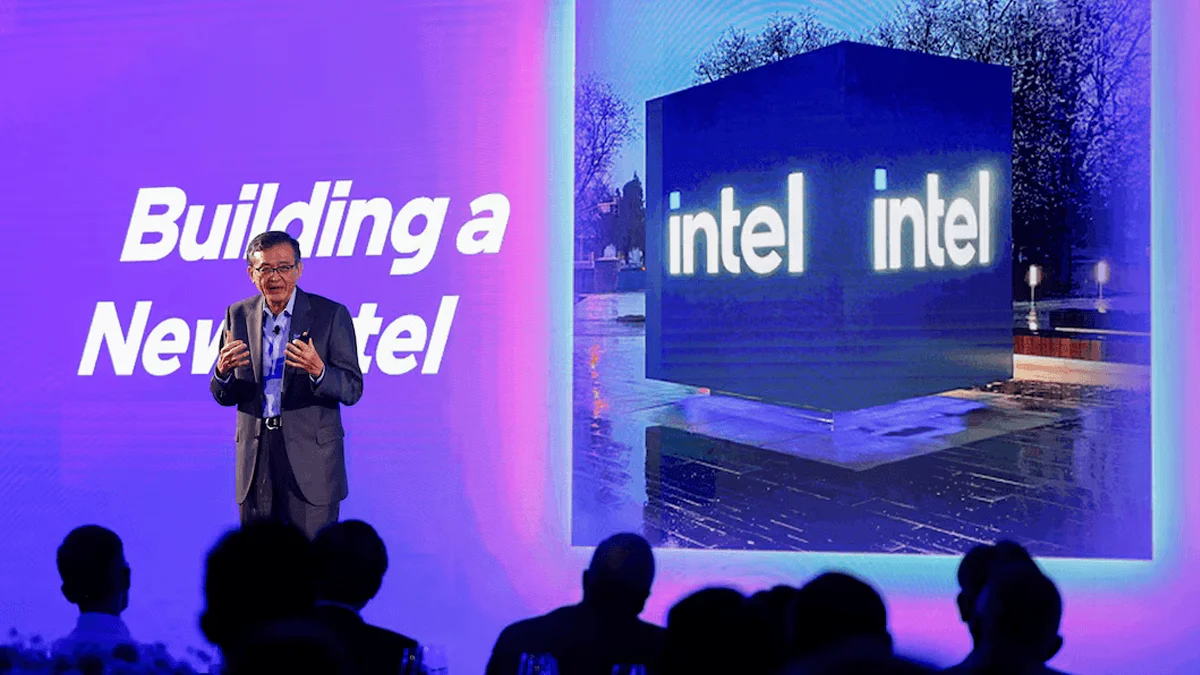

Intel CEO Lip-Bu Tan has shifted from the 18A chipmaking technology that his predecessor Pat Gelsinger spent billions of dollars developing. Instead, Tan has opted to focus on the next-generation chip manufacturing process known as 14A as he seeks to win large customers abroad.

This move will likely lead to a huge write-off that would please investors despite the company claiming that the new technology will enable it to compete against the world’s largest chip manufacturing factory, TSMC. Analysts expect Intel to announce write-off amounts of hundreds of millions or even billions of dollars in the earnings call.

Analysts at Stifel hold that Intel’s 14A foundry plan will take center stage in the upcoming earnings call compared to any other business in the American chip manufacturer. The huge write-off could affect the timeline for the Intel foundry to break even.

In May this year, Intel Chief Finance Officer David Zinser said the unit was expected to break even in 2027. Zinser also said that the company needed external customers to generate billions in revenue. The chip maker’s foundry unit is projected to generate $4.49 billion in sales revenue in Q2. However, analysts say most of this revenue will come from the chips that the company manufactures. Despite the current challenges, analysts say that the company’s strategic decisions are aimed at building stability and fostering growth.

Intel continues to face customers who are reluctant to spend due to uncertainties created by the US-China trade war.

Revenue from the company’s computer business is expected to drop by 2% to stand at $7.25 billion. This drop is a result of customers halting orders made in Q1 of this year following the US import tariff threat.

Intel isn’t the only tech company that is facing this challenge. TSMC and ASML have flagged the uncertainty created by the tariff war among the factors affecting their outlook. Texas Instruments, an analog chip manufacturer, cited similar problems in its earnings report on July 22. The announcement caused its stocks to plunge 11%.

Intel’s revenue from the data center business is expected to rise by 20% to a high of $3.66 billion. This increase points to rising demand for conventional server chips following multiple quarters of low sales.

As the company releases its Q2 earnings report, Intel investors will be watching keenly to see whether the company disposes of additional assets. They will also be seeking to know whether the chip maker plans to expand the layoffs it announced in 2024 or flatten its management structure further.