Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

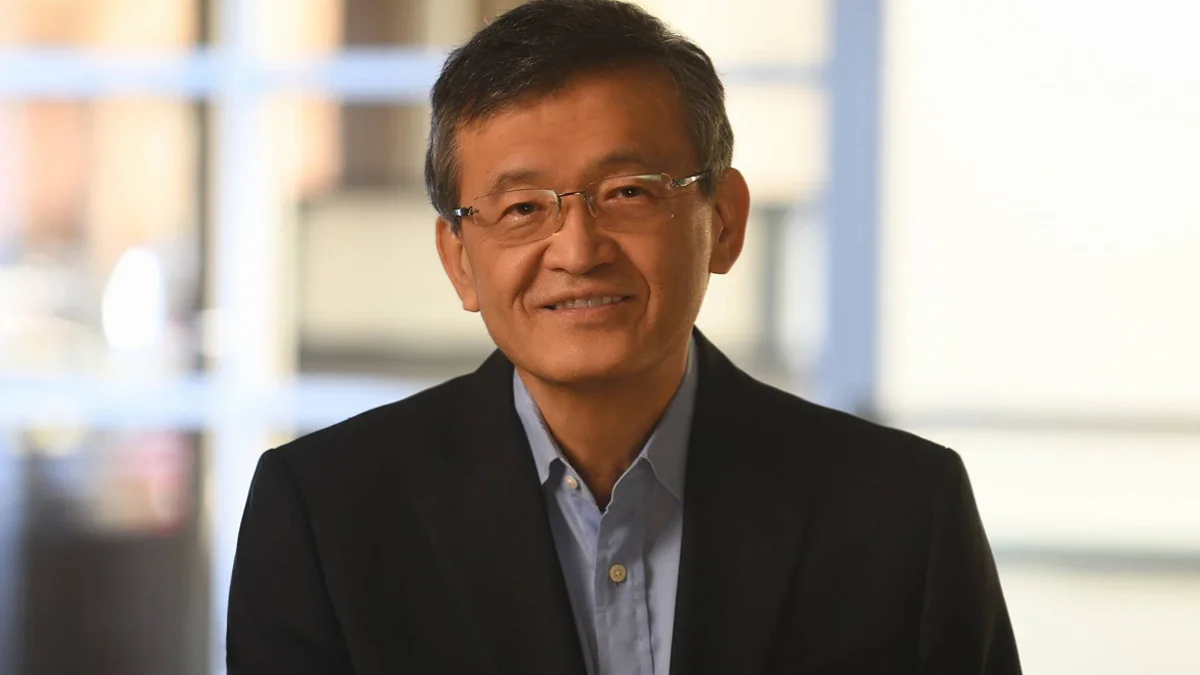

Wall Street analysts have been following Intel CEO Lip-Bu Tan closely, hoping that his tenure would mark the resurgence of the struggling chip giant. According to Yahoo Finance, the Intel shares surged by 12% in the pre-market trading on Thursday after the appointment of the new CEO.

The move to introduce Intel’s new CEO is timed at a period when the company has been shedding market share to competitors like AMD and NVIDIA, while its foundry segment has been unable to gain traction. Analysts believe that Tan’s extensive background in the semiconductor industry gives him a strong foundation to lead Intel. His experience as a leader at venture capital firm Walden International and former CEO of Cadence Design Systems further strengthens his ability to guide the company into the future.

The hiring of Lip-Bu Tan by Intel has sent the market into a state of mixed responses. While others are hopeful that his strategic foresight may serve to restore Intel to its previous dominance, some are doubtful as to whether even a seasoned executive such as Tan can overcome the firm’s deep-seated challenges.

Under previous CEO Pat Gelsinger, Intel started a high-stakes push to grow its foundry business and challengeTSMC. After the CEO, Pat Gelsinger resigned there was a shift in company’s leadership that concerned the shareholders. But, with Tan as the current head, everybody wants to see the new game face that will deliver faster innovation and better efficiency of operations.

Assuming the role of Intel CEO Lip-Bu Tan has both opportunities and major challenges. Intel continues to maintain a powerful position in the worldwide semiconductor business with a rich collection of chips and its past record of technological innovation. Intel also has the challenge of being increasingly under pressure from competitors, supply chain interruptions, and eroding profit margins.

One of Tan’s main areas of emphasis will be to sharpen Intel chipmaker strategy so that the company can compete effectively in the AI and data center spaces. Intel has spent a lot of money on AI-based chip designs, but it has not yet achieved the same level of success as NVIDIA in this area. Tan will have to use his experience to align Intel’s R&D with market needs and fuel growth in new technologies.

In February, analysts suggested that splitting Intel could boost the valuation to $200 Billion. This came as a reaction when TSMC was trying to control the company’s manufacturing plants.