Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

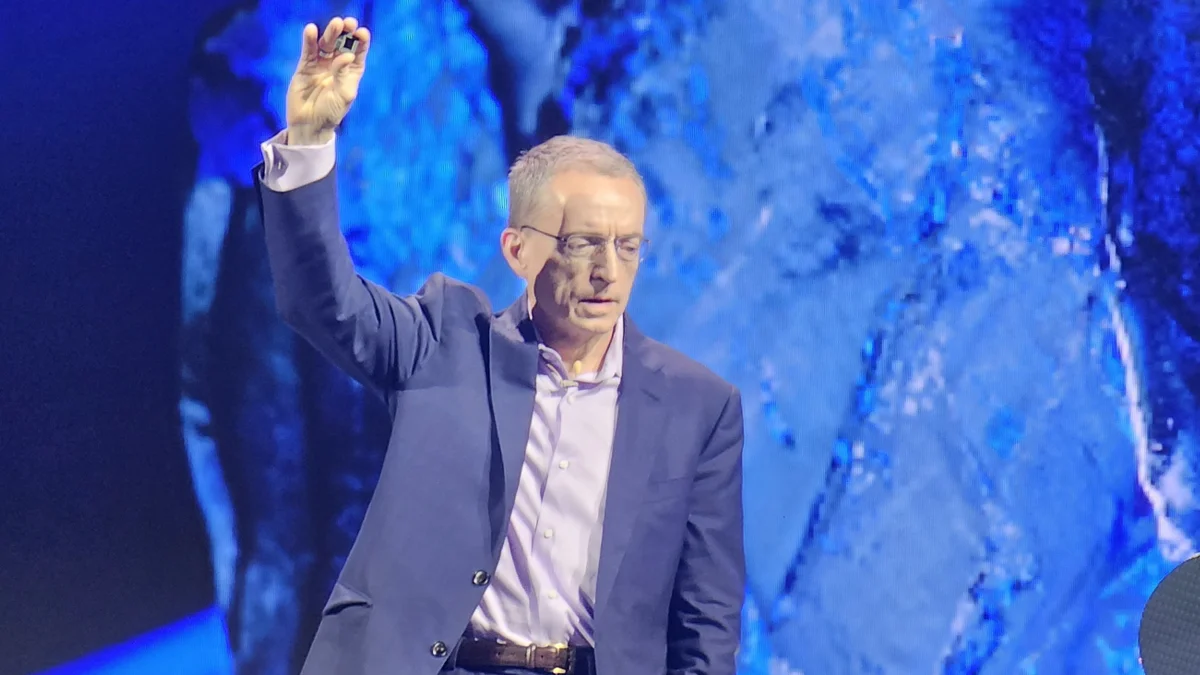

CEO Pat Gelsinger has left Intel after the board lost confidence in him. The board at Intel forced the CEO out less than four years after he took over the company’s leadership. Gelsinger resigned on December 1, 2024.

According to Reuters, Gelsinger’s resignation came following a board meeting where Intel directors felt that the Intel CEO’s costly turnaround plan was not working. Sources close to Intel say that the board asked Gelsinger to retire or get fired. He chose to step down.

Under the leadership of Gelsinger, Intel’s market value has reduced to a point where the former tech leader is now over 30 times smaller than AI chip leader- Nvidia. In 2021, the Intel CEO took over a company that was already struggling. His tenure in the chip maker has compounded the challenges it was facing at the time.

Under Gelsinger’s watch, Intel lost or canceled contracts for setting lofty, ambitious targets for AI and manufacturing capabilities among key clients. This affected Intel’s ability to meet customer orders. Gelsinger’s optimistic claims regarding potential AI-chip deals that surpassed the company’s estimates. This caused the company to review its revenue forecasts about a month ago.

Intel CEO resignation from the chip maker gives Intel a new opportunity to consider other potential options. In recent months, the Intel board has been discussing various possibilities, including private equity and establishing separate product-design and factory business units. Gelsinger was against splitting the company. Instead, the Intel CEO focused on his big plan to restore the company’s technological edge. Following his departure this week, Intel has a chance to reset this conversation.

The Goldman Sachs Group and Morgan Stanley have been supporting the chip manufacturer to think through its options. The incoming management may be more receptive to their ideas. Gelsinger’s departure also allows suitors like Qualcomm Inc. to take another shot at acquiring sections or the entire Intel business.

“This leadership change increases the probability of divestitures. Gelsinger was firmly against breaking up the company, but the prolonged and expensive turnaround has tested shareholder patience, potentially forcing Intel to reconsider,” Bloomberg Intelligence Analysts Kunjan Sobhani and Oscar Hernandez Tejada said.

In its September 2024 meeting, the Intel board considered several scenarios, including breaking up the giant tech company. The conversion was triggered by the disappointing quarterly earnings report presented the previous month where Intel posted a loss and reviewed its sales forecasts downwards. Even after this meeting, Intel continued to implement less radical changes that included pausing construction of plants in Germany and Poland.

If the next CEO pushes ahead with a massive shake-up, Intel could revisit several options. These could include splitting product and factory divisions. This will mean separating the factory business from the profitable unit where Intel products are developed. It remains unclear whether the board will be willing to dismantle the tech company. Such a move could compromise the company’s ability to receive the $7.9 billion Chips Act funding from the federal government.

Intel could also decide to sell its Altera unit where it manufactures reprogrammable chips. Previously, the company has negotiated the sale of a section of this unit to financial investors. Selling off the Altera unit could boost the company’s momentum. Intel could also pursue investment talks with Apollo Global Management. Earlier this year, the investment firm had offered to make up to $5 billion investment in Intel. However, the negotiations did not materialize. Apollo already invested $11 billion in Intel’s Ireland chip plant.

Under the new CEO, Intel may offload some of the stake it holds in Mobileye, a self-driving tech company it acquired in 2017 after paying $15 billion. The company went public in 2022. Mobileye is currently valued at $14.1 billion and it’s highly unlikely that it will be a winning investment for Intel.