Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

Danish fintech startup Light has raised $30 million in Series A funding round. According to CNBC, Light raised funding from Revolut backers to integrate AI in accounting software. Revolut and GoCardless investor, Balderton Capital led Light’s funding round.

Light develops tools for automating finance-related tasks, including compliance, book-keeping, and reporting. By integrating AI in fintech, the Copenhagen-based company is betting on AI to take on legacy systems developed by tech giants that have dominated the accounting industry. These companies include Oracle, Microsoft, and SAP.

AI fintech firm Light plans to use the latest funding to boost the commercial aspect of its business. Light opened its London office recently, just as fintech firm GoCardless has also plans to open a new office in Leeds as part of its U.K. expansion strategy. Light plans to open a second office in New York soon to meet U.S. demand.

Speaking to CNBC, Light CEO and co-founder Jonathan Sanders said, “We service fast-growing, fast-scaling companies who need a system where they can expand really fast.”

Besides receiving backing from Revolut’s startup investor, Light’s financing round attracted prominent angel investors like Meta board member Charlie Songhurst and Hugging Face co-founder Thomas Wolf. Seedcamp, Atomico, Cherry Ventures, and Entrée Capital also participated in the funding round.

The presence of Balderton Capital investment in Light and the investor lineup indicates serious confidence in Light’s approach to disrupting the accounting market. In June 2025, Revolut CEO struck a multi-billion deal based on a $150 billion valuation. The digital bank has been mulling an IPO, but the timing remains unclear. Earlier this month, a secondary share sale pushed Revolut’s valuation to $75 billion, up from the previous $45 billion.

There are other startups seeking to streamline corporate accounting and finance processes with AI. Some of the players that the Danish fintech will be competing against include Pennylane and Pigment. Pennylane is an accounting software firm that raised $88.4 million recently. This financing pushed its valuation to 2 billion euros.

Pigment, on the other hand, is a business planning and forecasting platform that offers a user-friendly experience than Microsoft’s Excel. The fintech startup raised $145 million in 2024 at a valuation of more than $1 billion.

Pigment, a business planning and forecasting platform designed to be more user-friendly than Microsoft Excel, last year raised $145 million at a valuation north of $1 billion. More recently, accounting software startup Pennylane raised 75 million euros ($88.4 million), doubling its valuation to 2 billion euros.

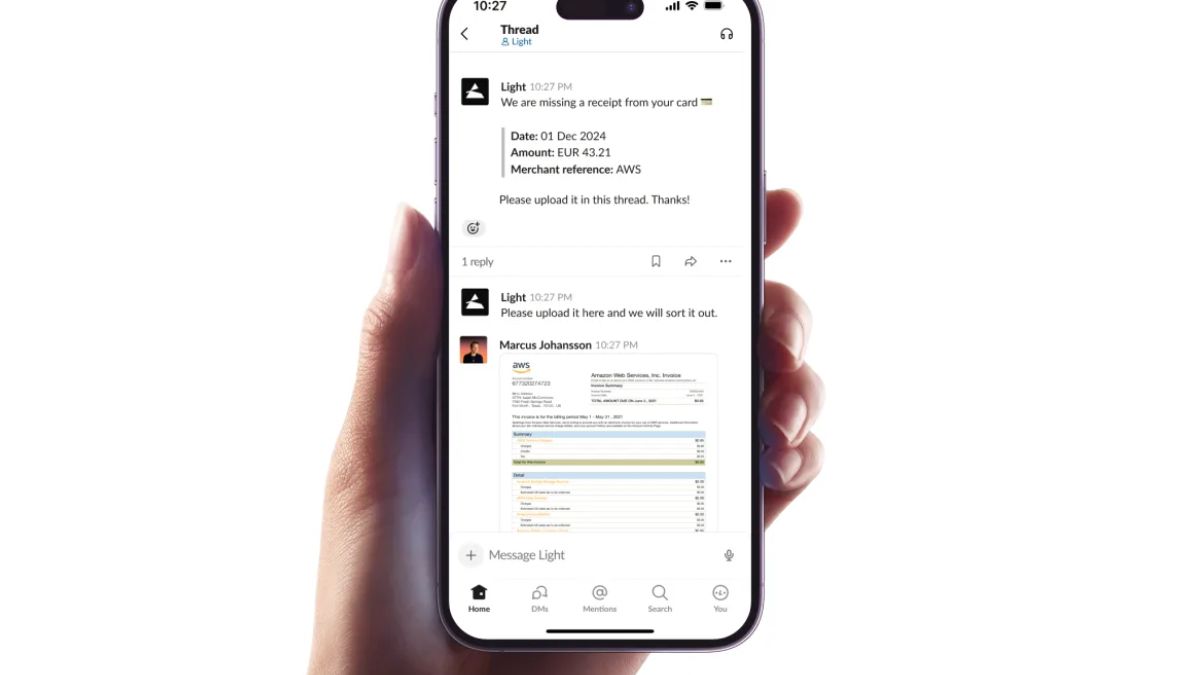

According to Light, setting up finance software should not take months or require support from consultants. The company says its AI-powered solution understands internal policies instantly and automates processes like identifying reimbursable expenses.

“The future of numbers is text. AI can read and reason through complex policies faster than any human team ever could,” Sanders added.

Founded in 2022, Light says its focus is on large, enterprise clients struggling with “broken processes and workflows”. “No human team can continuously analyze, reconcile and update thousands of pages of policies for coherence,” Sanders added.

Light products and offerings are already being used by customers like AI firms Lovable and Sana Labs, which was recently acquired by Workday for $1.1 billion. Sana offers a range of products that include corporate training and an AI agent that helps with tasks like note taking. Light’s customer-base, coupled with rising investor interest points to growing demand for AI-driven tools in corporate finance.