Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

UK regulator, Financial Conduct Authority (FCA) has partnered with US chip manufacturer Nvidia to enable banks to experiment safely with AI. According to CNBC, the FCA plans to do this through a Supercharged Sandbox. The FCA Nvidia AI sandbox will “give firms access to better data, technical expertise and regulatory support to speed up innovation.”

The latest FCA AI testing framework is part of the UK government’s strategy to enhance innovation and economic growth. The financial services regulator plans to roll out the AI sandbox to financial institutions starting October 2025.

Through the UK financial services AI sandbox, institutions will be able to experiment with Nvidia’s accelerated AI and computing enterprise software products within a controlled environment.

“The FCA’s Supercharged Sandbox provides firms with a secure environment to explore AI innovations using NVIDIA’s full stack accelerated computing platform, supporting industry-wide growth and efficiency,” Nvidia Germany-based Head of Fintech in EMEA, Dr. Jochen Papenbrock said.

According to the FCA, the Nvidia initiative is designed for banks that want to discover and experiment with AI. The financial regulator added that a live testing service already exists for institutions that have already started developing AI.

“This collaboration will help those that want to test AI ideas but who lack the capabilities to do so. We’ll help firms harness AI to benefit our markets and consumers, while supporting economic growth,” Jessica Rusu, Chief Data, Intelligence and Information Officer at the FCA said.

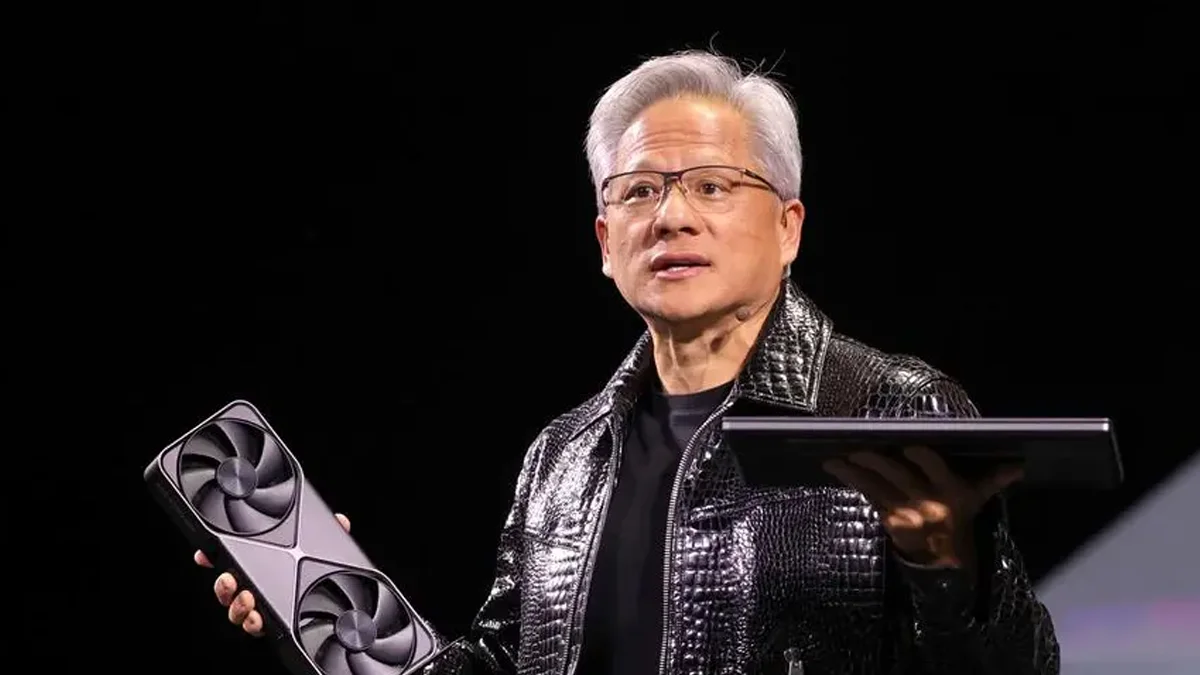

Speaking during the partnership announcement, Nvidia CEO Jensen Huang said the UK does not have the computing infrastructure needed to deliver its AI research base. Huang said that the UK is an ‘incredible place to invest. He also acknowledged Starmer’s plan to grow Britain’s computing capabilities 20-fold and offer $1.36 billion in investment.

“The UK is the largest AI ecosystem in the world without its own infrastructure. The ability to build these AI supercomputers here in the UK will naturally attract more startups, it will naturally enable all of the rich ecosystem of researchers here,” Huang said during the London Tech Week. The event was attended by UK Prime Minister Keir Starmer.

UK Finance Minister Rachel Reeves has asked regulators in the country to eliminate economic barriers that hinder growth. She said this is a top priority for the government. Back in April, Reeves said she was impressed by the way the Prudential Regulation Authority and the FCA had responded to her request for less bureaucracy.

“AI is fundamentally reshaping the financial sector by automating processes, enhancing data analysis, and improving decision-making, which leads to greater efficiency, accuracy and risk management across a wide range of financial activities,” Dr. Papenbrock added.

The UK financial regulator sandbox focuses on important issues that affect financial institutions. British banks have been experiencing challenges shipping advanced AI tools to their customers amidst rising concerns on fraud and privacy.

Large language models such as Google and OpenAI send data back to their overseas facilities. In recent years, regulators have raised concerns over how this data is processed and stored. Nvidia is the leading provider of graphics processing units (GPUs), the critical hardware used to train and operate advanced artificial intelligence models.

This is not the first time that the UK Financial Conduct Authority has launched a regulatory sandbox. The regulator first rolled out the world’s first sandbox back in 2016. Since then, the watchdog has expanded its experimentation framework to include a digital sandbox. In September 2024, the FCA partnered with the Bank of England to introduce the ‘Digital Securities Sandbox’ aimed at testing emerging technologies in financial markets.