Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

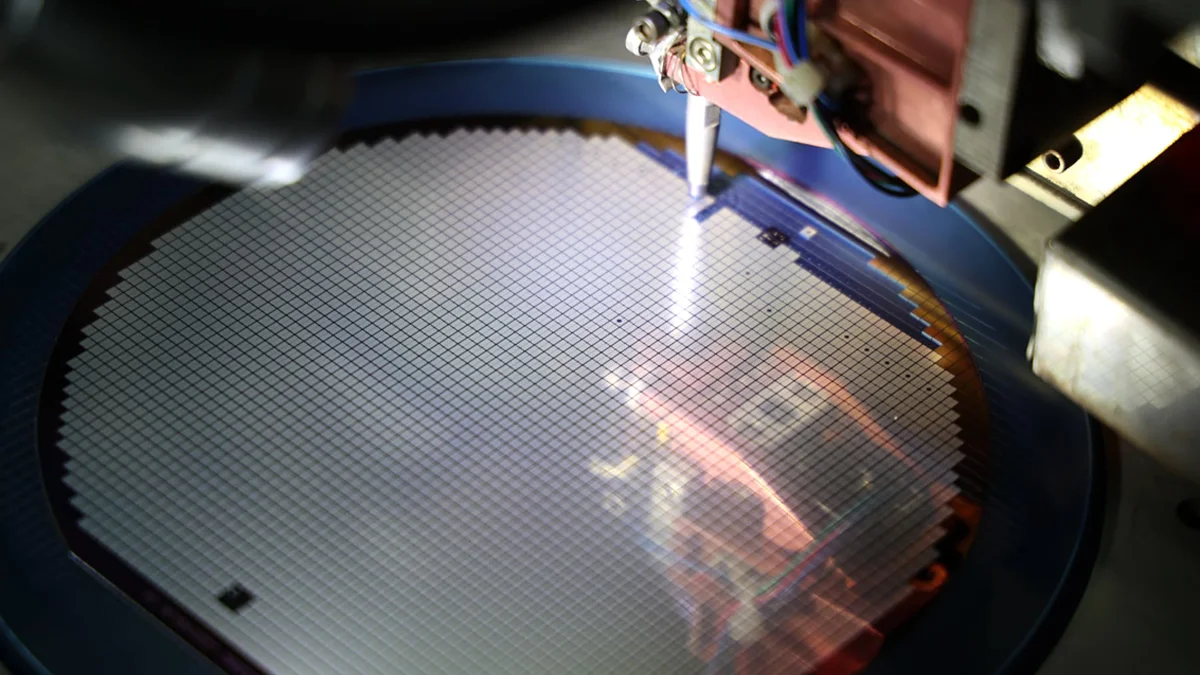

Share prices for semiconductor manufacturers in the US, Europe, and Asia dipped on October 16, 2024. Reuters reported that the ASML AI chip stocks fall was triggered by the downward review of annual sales forecasts by the Dutch chip maker, who cited low demand for non-AI chips.

ASML’s disappointing forecast triggered the largest selloff the company has experienced in two decades. According to CNBC, ASML reported that it expects its 2025 sales to range between $32.7 billion and $38.1 billion.

These figures are at the lower half of the company’s previous projections. ASML’s CEO raised concerns over customer caution, saying that recovery will be slower than it was previously anticipated.

ASML stocks continued to drop for the second day running. On October 15, 2024, the stocks dropped by 16%, which represents a $53.6 billion loss in market capitalization in one day. ASML’s disappointing forecast extended the drop in AI chip stocks to other EU-based chip manufacturing firms on October 16, 2024.

Share prices for Dutch-based wafer processing equipment supplier, ASMI dipped by 2.3%. BE Semiconductor, which makes Compatriot chip equipment, dipped by 1.9% while STMicroelectronics shares fell by 1.2%. Stocks for German-based chip manufacturer, Infineon dropped by 1.1%. France-based semiconductor material maker, Soitec experienced a 0.9% drop in its stocks.

AML’s sales warning caused stocks for the leading AI chip manufacturers to plunge. Nvidia stocks dropped by 4.7% while those of AI chip maker, AMD lost 5.2%. Nvidia shares tanked just a day after they reached their highest price. The drop reduced Nvidia’s market capitalization by $158 billion, further widening the capitalization between Nvidia and Apple.

The global chip stocks erase had a big impact on Asian stocks. Japan-based Tokyo Electron dipped by close to 10%. Renesas Electronics lost 3% while testing equipment supplier Advantest dropped by 0.8%. Stocks for South Korea-based SK Hynix, the company that makes high bandwidth memory chips for Nvidia’s AI applications closed 1.6% lower.

Share prices for the world’s biggest manufacturer of dynamic random-access memory chips, Samsung also dipped by 1.9%. Other leading Asian companies whose stocks lost value following AML’s sales warning were Foxconn and Taiwan Semiconductor Manufacturing Company.

The global fall in chip stocks affector major indexes in Asia’s semiconductor sector. In South Korea, the Kospi index dropped by 0.6% while the Nikkei 225 index in Japan dropped by more than 2%. Taiwan’s Weighted Index was also affected, dipping by 0.7%.

Following the global ASML AI chip stocks fall, investors have become skeptical about the Dutch chip manufacturer’s market outlook. As the EU’s most valuable tech company, ASML’s position as an important chip supplier is not in question. However, investors and analysts have raised doubts about whether its sales in the short run will outgrow the overall market in the long run.

“There need to be limits to the expectations we investors put in any single company. That’s especially the case for an upstream equipment supplier highly reliant on the spending plans of its manufacturing customers,” Concinnus Financial and ASML Investor Nick Rossolillo said.

The company said its outlook for non-AI chip demand was informed by the fact that some of its customers, who include companies that manufacture logic chips that are used in PCs and smartphones, had reported delays in upgrading and setting up new plants. The company said memory chip manufacturers had also reported fewer expansions.

Investor skepticism around the semiconductor industry has also been spurred by reports of a US AI chip export cap. On October 15, 2024, Bloomberg reported that the discussions about limiting the sale of advanced Nvidia AI chips to some countries due to national security concerns had already commenced.