Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

The world of computing technology is ever-evolving, and with the latest developments and some of the greatest minds at work, the AI market has become a competitive area of battle. The world’s two top-leading performers in graphics, NVIDIA and AMD, have been leading the gaming rigs. They have made their mark in the tech space with many advances, from everyday computers to making the dreams of gamers true; the GPU makers are competing against each other. If you are one wondering which one to choose or even how the market is treating them, then this article is for you. We are covering the NVIDIA vs AMD GPU comparison for you to make the decision better and faster.

Over the past decade, GPUs have evolved from graphics accelerators into the backbone of parallel computing. They now drive training for large language models, real-time rendering in video games, and energy-efficient performance in supercomputing. These two influential forces are practically running the GPU ecosystem, and to understand NVIDIA vs AMD GPU comparison better, it’s important to compare their strategic market positioning and history better. Let’s begin from where it all started.

Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, NVIDIA is headquartered in Santa Clara, California. The company has established itself in over 38 countries with 36,000 employees across the world. From gaming GPUs to AI/data center hardware, NVIDIA has dived into automotive solutions and developer solutions as well.

NVIDIA dominates the GPU market with over 92–94% of the discrete GPU market in Q2 FY25, as per Yahoo Finance. For GPUs used in AI model training and supercomputers, estimates place NVIDIA GPU market share at 80–95% as of 2025, highlighting its strength in AI GPU market competition.

Recently, in a high-profile address at its Washington, D.C. developer event, NVIDIA Corporation CEO Jensen Huang announced that the company will build seven new supercomputers for the U.S. Department of Energy (DOE), marking a major push into national-scale infrastructure.

The tech giant has proved itself time and again with only numbers rising, be it for revenue or for subscribers. More than 200 million gamers and creators use NVIDIA GeForce GPUs, and over 40,000 companies power their AI factories with NVIDIA AI technologies.

The company is also invested in ensuring that the upcoming creators and developers get access to their facility by engaging around 6 million developers through its program and by supporting 27,000 startups globally. Its NVIDIA AI chip performance has set industry benchmarks, further influencing the NVIDIA vs AMD GPU comparison.

AMD is also running ahead in this race of NVIDIA vs AMD GPU comparison, with its high-performance and adaptive computing technology known for powering various systems across industries.

AMD, established in 1969, originally focused on microprocessors before entering the graphics market. Its 2006 acquisition of ATI Technologies marked a major turning point, enabling AMD to integrate CPU and GPU technologies under one umbrella.

This synergy became central to its product strategy, exemplified by the company’s APU (Accelerated Processing Unit) line. Under CEO Dr. Lisa Su, AMD’s resurgence over the past decade has been driven by innovation in both its Ryzen CPUs and Radeon GPUs, powered by its RDNA architecture.

The company has also advanced AMD GPU for deep learning, expanding its footprint in AI acceleration and professional computing.

Key takeaway:

NVIDIA dominates through an early focus on AI-centric GPU design and a deep ecosystem (CUDA, cuDNN, DGX), while AMD leverages CPU-GPU integration and open architectures to compete on flexibility and cost.

Related Post – Tesla vs. BYD: Who’s Winning the Global EV Race?

Another important factor to consider while discussing NVIDIA vs AMD GPU comparison is the product comparison of these tech titans. Let’s take a detailed look at the NVIDIA vs AMD GPU comparison in terms of product offerings.

NVIDIA’s product line is a broad and strategically diversified portfolio that emphasizes leadership in graphics, AI, and data center computing. At the core is the GeForce series, with the latest RTX 50 Series GPUs delivering ultra-high performance for gaming and content creation, featuring cutting-edge AI acceleration and ray tracing technology.

For professionals, NVIDIA offers the RTX professional line and specialized GPUs that excel in visualization, scientific simulation, and complex AI workloads, all driven by impressive NVIDIA AI chip performance. Recently, NVIDIA explored a $500 million investment in the U.K.’s autonomous driving technology firm, Wayve.

NVIDIA also leads in networking and data infrastructure with products like BlueField DPUs and Quantum-X switches, enhancing cloud scalability and AI workload efficiency. In automotive, its DRIVE platform encompasses hardware and software stacks that power autonomous driving through AI.

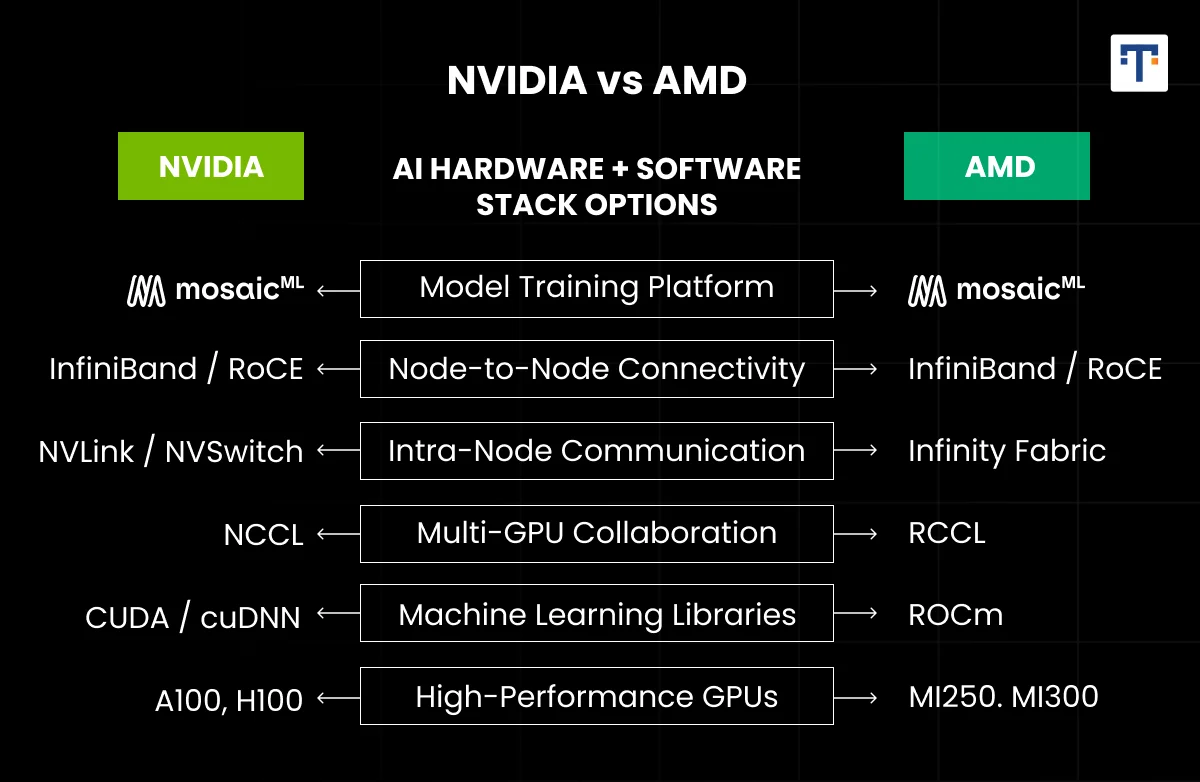

On the software front, NVIDIA supports its hardware with CUDA-X and AI Enterprise platforms, which are essential for developers and researchers working on AI innovation and scientific computing. This also brings into focus the NVIDIA CUDA vs AMD ROCm comparison, as both ecosystems shape AI development workflows.

Additionally, Omniverse is NVIDIA’s metaverse platform, enabling 3D simulation and collaboration widely used in industries ranging from entertainment to industrial design. The company’s Shield product line caters to gaming and media streaming devices. This diverse product ecosystem is designed to integrate AI, graphics, and computing across consumer, professional, and enterprise domains, a strategy that solidifies NVIDIA as a dominant force in technology innovation.

AMD’s product line in 2025 is a thorough portfolio that competes closely with NVIDIA, focusing on high-performance CPUs, GPUs, and AI-enhanced computing solutions. At the heart of AMD’s offerings are the Ryzen processors, including the Ryzen 9000 series with Zen 5 architecture, which power desktops, laptops, and gaming devices with high core counts, efficiency, and integrated AI capabilities.

For professionals, AMD provides the Ryzen PRO line with enhanced security and manageability, alongside the Ryzen Threadripper series aimed at high-end desktops and workstations.

In the GPU segment, AMD’s Radeon RX 9000 Series GPUs, built on the RDNA 4 architecture, target gamers and content creators with powerful graphics and AI features, providing competitive alternatives to NVIDIA’s GeForce line.

Additionally, Radeon Pro graphics cards serve professionals needing workstation-grade performance, while Radeon Instinct GPUs focus on AI acceleration and data center workloads, rivaling NVIDIA’s data center GPUs and expanding AMD GPU for deep learning solutions. On October 14, 2025, AMD signed a deal to supply AI chips to Oracle for its cloud infrastructure.

AMD is also a key player in embedded systems with the Ryzen Embedded processors and semi-custom solutions powering gaming consoles like PlayStation and Xbox. The company has enhanced its AI portfolio with the Ryzen AI Max and Ryzen AI 300 series processors, integrating dedicated Neural Processing Units (NPUs) delivering up to 50 TOPS of AI performance, catering to emerging AI workloads for consumers and enterprises.

AMD’s acquisition of Xilinx brought field-programmable gate arrays (FPGAs) and system-on-chip innovations, expanding their reach into customizable computing applications used in telecom, automotive, and data centers. The EPYC line of server processors is highly competitive in the enterprise sector, providing scalable performance for cloud and HPC environments.

Overall, AMD’s product line spans consumer, professional, enterprise, and embedded markets, blending CPU and GPU technologies with growing AI-focused hardware to challenge NVIDIA’s dominance, especially in cost-performance balance, open ecosystems, and integrated AI computing, a central topic in NVIDIA vs AMD GPU comparison discussions.

Key takeaway:

NVIDIA’s H100 and Blackwell chips lead in AI training and inference, whereas AMD’s MI300 series narrows the gap by combining high memory bandwidth and efficient chiplet design, giving buyers credible alternatives in AI workloads.

The data center sector has become the cornerstone of both companies’ growth strategies. NVIDIA currently dominates this market with its Hopper architecture and flagship H100 Tensor Core GPU, which power many of the world’s leading AI data centers, including those used by Amazon, Microsoft, and Google. Its CUDA ecosystem, combined with software stacks like cuDNN and TensorRT, gives NVIDIA a formidable moat in AI development, strengthening its NVIDIA AI chip performance lead.

In the data center space, NVIDIA’s DGX systems stand out as powerful AI supercomputers designed for enterprise deep learning and large-scale analytics. These systems often integrate NVIDIA’s latest Blackwell GPUs and Grace CPUs, which are tailored for high-performance AI, HPC, and cloud computing tasks. Embedded markets are served by Jetson and Tegra SoCs that bring AI and GPU acceleration to robotics, automotive, and edge devices.

According to the company’s fiscal Q2 2025 results, NVIDIA reported $22.1 billion in quarterly revenue, with $14.5 billion coming from data center products, a year-over-year increase exceeding 170 percent. The surge reflects the global demand for AI training infrastructure following the proliferation of generative AI models and intensifying AI GPU market competition.

AMD, while smaller in data center market share, has made significant strides. Its Instinct MI300 series, based on the CDNA 3 architecture, integrates CPU and GPU components into a single package for optimized performance per watt. It’s MI300 series made it one of the best AI chip companies in 2025.

Major cloud providers, including Microsoft Azure and Oracle Cloud, have adopted AMD accelerators to diversify their hardware offerings. AMD’s open software framework, ROCm (Radeon Open Compute), continues to evolve as a viable alternative to CUDA, showcasing the growing NVIDIA CUDA vs AMD ROCm debate.

Key takeaway:

NVIDIA currently dominates data-center AI deployments with its software stack and large installed base, but AMD is gaining traction through partnerships with hyperscalers and its open ROCm platform.

Financially, NVIDIA’s meteoric rise has positioned it as one of the most valuable companies globally. As of late 2025, its market capitalization exceeds $1.3 trillion, propelled by the AI hardware boom. The company’s gross margins remain above 70 percent, supported by strong pricing power in high-end GPUs and software licensing, further proof of dominant NVIDIA GPU market share.

AMD, while smaller in scale, has shown robust growth and profitability. Its market capitalization hovers around $250–300 billion, with annual revenue surpassing $25 billion. AMD’s strategic focus on balanced growth across gaming, data center, and embedded solutions has yielded consistent double-digit annual revenue increases over the past five years. However, there was a small hiccup in between for AMD when Q2 results surpassed analyst revenue estimates but fell short on adjusted earnings per share.

Both companies invest heavily in research and development; NVIDIA’s R&D spending in fiscal 2025 exceeded $8 billion, while AMD allocated around $5 billion, reflecting the capital intensity required to sustain innovation in semiconductor design. Their continued advancements depend on close collaboration with foundry partners such as TSMC, which manufactures both firms’ leading-edge GPUs on 4 nm and 5 nm process nodes.

Key takeaway:

NVIDIA’s massive revenue growth and market cap reflect its AI leadership and pricing power, while AMD’s steady financials highlight long-term resilience and diversification across CPUs and GPUs.

The NVIDIA vs AMD GPU comparison is more than a rivalry between two semiconductor firms; it represents the driving force behind decades of technological progress. NVIDIA’s dominance in AI and premium GPUs has made it a cornerstone of modern computing infrastructure, while AMD’s commitment to innovation, efficiency, and open standards ensures meaningful competition across markets.

Both companies have demonstrated exceptional adaptability, responding to global trends in AI, gaming, and cloud computing with speed and precision. As the world transitions toward increasingly intelligent and data-intensive workloads, their innovations will continue to redefine performance boundaries and economic models across industries.

Sign up to receive our newsletter featuring the latest tech trends, in-depth articles, and exclusive insights. Stay ahead of the curve!