Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

In the ever-evolving smartphone industry, Google Pixel vs iPhone is one such topic that is stealing the show with igniting debates from office boardrooms to coffee shops. In recent years, Google Pixel has been emerging as a powerful contender, but Apple’s iPhone has also stood its ground with refined user-experience and industry-leading performance.

The rising competition between Google Pixel vs iPhone makes it tough for market specialists to make an informed choice. Well, to understand these platforms better, we should first reflect on the early days of both Google Pixel and iPhone.

In this article, we will be discussing the global positioning, financial performance, and market evolution of iPhone and Google Pixel within the enterprise technology landscape. With rising competitive dynamics in the enterprise sector, it is essential to understand the evolution of Google Pixel vs iPhone to strategically make informed policy and investment in the modern digital workplace.

Before diving deep into Google Pixel vs iPhone, it is important to understand the history of these two giants. How Apple’s iPhone and Google’s Pixel originated and evolved over a period of course.

Learned from its earlier initiative Nexus, Google launched Pixel series in 2016 after thorough research and understanding smartphone market mechanics. This marked Google’s strategic shift from hardware partnerships to direct device manufacturing and control.

While the Nexus program relied on third-party manufacturers, Pixel devices showcase Google’s vision for Android optimization and AI integration. The evolution from Pixel 1 through the current Pixel 9 series presents Google’s commitment to challenging Apple’s premium positioning while leveraging its dominance in services and cloud computing. While the previous Pixel series were a hit, what stood out amongst all is the Google Pixel 8 with brand-new AI integrated camera.

By controlling both hardware and software optimization, Google can deliver features that showcase its AI capabilities while ensuring seamless integration with Google Workspace and other business-critical services. This vertical integration strategy mirrors Apple’s approach while emphasizing Google’s strengths in data processing and machine learning.

Launched in 2007, Apple’s iPhone has changed the smartphone industry by establishing itself as a blueprint for premium devices in the world. Building on Apple’s 1980 IPO success, which provided substantial capital for research and development, the company has maintained an annual flagship release cycle that consistently drives innovation and market leadership till date.

Apple’s systematic approach to product development, supported by decades of accumulated R&D investment, has created a sustainable competitive advantage in the premium segment.

The iPhone’s evolution from a consumer-focused device to an enterprise-grade platform reflects Apple’s strategic pivot toward business markets. Since 2014, Apple has invested heavily in enterprise partnerships and security frameworks, recognizing that business adoption drives both volume sales and ecosystem lock-in.

This transformation has positioned the iPhone as the default choice for organizations prioritizing security, user experience, and seamless integration across device categories.

What decides a company’s fate in sustaining long-term hurdles is its financial reserves. Apple and Google have made a commitment of enhancing its innovation in the technology sector by systematically allocating its funds and using its reserves.

The areas of focus remain the same which aligns with the company’s priorities – research, development, and strategic expansion. Furthermore, to better understand the funding & financial milestone of Google Pixel vs iPhone, let’s take a look at the strategic investments of both platforms.

Alphabet, Google’s parent company, heavily spends on R&D. As per Macrotrends latest report, $52.9 billion spent on R&D in the twelve months through June 2025. Alphabet not only surpasses Apple in annual spend but also signals its intent to lead in cloud, AI, and next-gen hardware.

This investment strategy positions Pixel as a showcase for Google’s technological capabilities rather than merely a hardware revenue generator. The Pixel investment model reflects Google’s strategic emphasis on ecosystem consolidation and service platform enhancement rather than immediate hardware revenue generation.

By utilizing Pixel devices as demonstration platforms for Android’s advanced capabilities, Google ensures optimal service integration. Furthermore, Google also maintains competitive pricing structures that directly challenge Apple’s premium market approach. This strategy sustains profit margins through comprehensive service ecosystem monetization.

Apple has strongly positioned itself as a financial leader not just with making profits but also reinvestments. The company generated $390.8 billion in revenue in 2024, with iPhone sales contributing 51% of total revenue as per a report by Visual Capitalist. According to Yahoo Finance, Apple’s most recently reported cash reserves as of the end of March 2025 are approximately $48.5 billion in cash and cash equivalents.

Hosted on Apple’s newsroom, Apple’s Q4 2024 consolidated financial statements detail that Apple’s R&D expenses for fiscal 2024 were approximately $31.4 billion.

This investment level, representing approximately 8% of revenue, establishes Apple’s commitment to maintaining technological leadership across multiple product categories. The company’s ability to fund long-term projects, including silicon development and advanced manufacturing processes, creates sustainable competitive advantages that competitors struggle to match.

When it comes to understanding Google Pixel vs iPhone, it is important to take into consideration the geographical distribution which is driven by distinct pricing methodologies, different ecosystems, and regional brand positioning as well. Let’s take a look into the market dynamics for iPhone and Google Pixel.

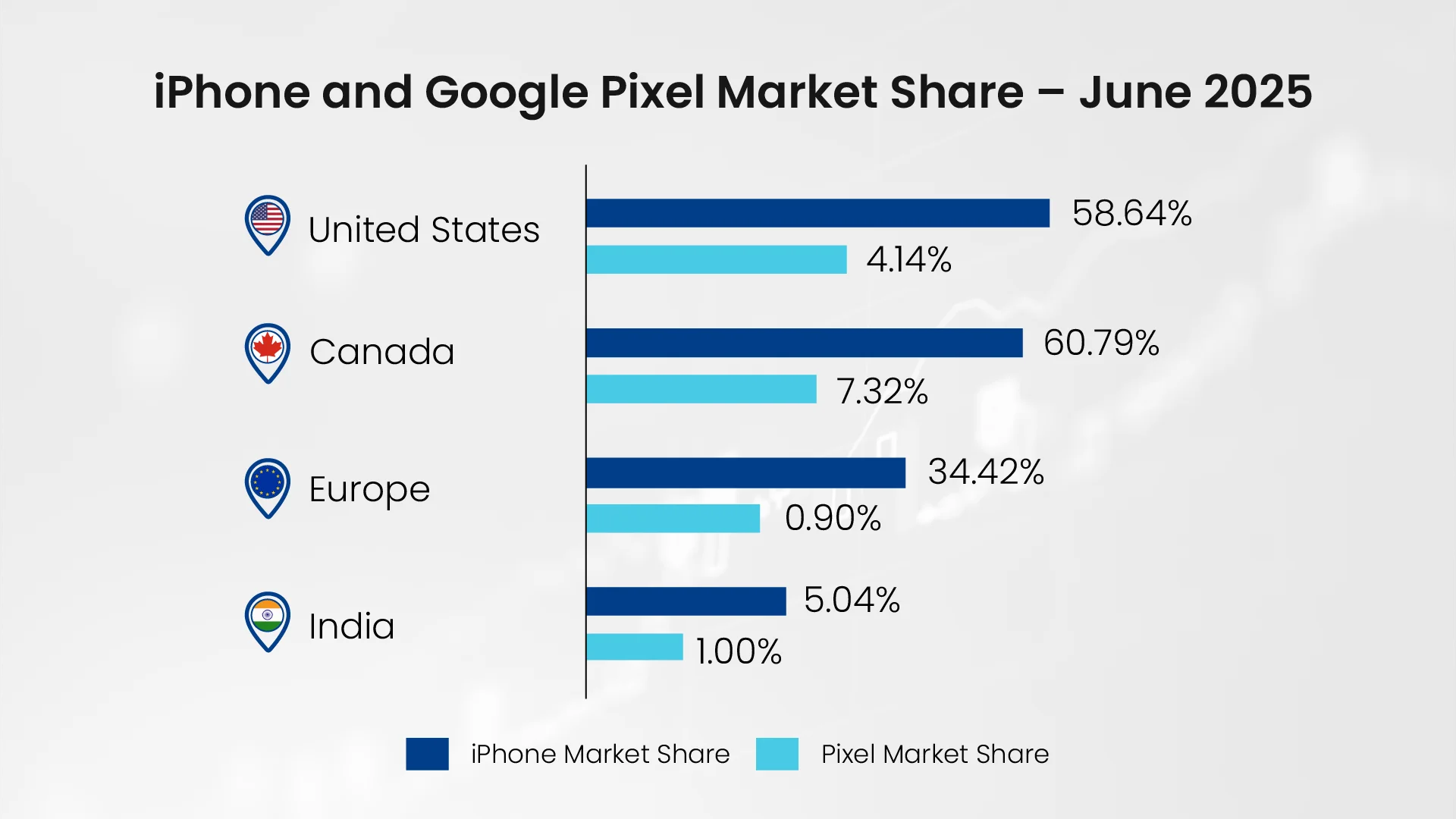

The U.S. smartphone market reveals distinct patterns in enterprise adoption and consumer preferences. Google Pixel has achieved record growth, reaching 12% market share in 2024, representing the highest quarterly performance in Pixel’s history. According to OBERLO, Apple maintains 57.39% smartphone market share as of September 2024, establishing sustained dominance in the world’s most lucrative mobile market.

Google Pixel achieved a rise from 4.76% in September 2024 to 12.9% in October 2024, its highest quarterly performance, indicating growing acceptance among business users. This growth trajectory suggests that organizations are increasingly willing to consider Android alternatives when supported by robust security frameworks and enterprise management capabilities.

European markets demonstrate distinct preferences for premium devices with strong privacy and security credentials. Both iPhone and Pixel target high-value business consumers who prioritize data security, regulatory compliance, and seamless productivity integration.

European organizations, particularly those subject to GDPR requirements, evaluate mobile devices based on privacy architecture, data residency options, and compliance framework support.

Apple maintains dominant brand allegiance across Western Europe and the UK, achieving 89% iPhone user retention rate as of 2025. This preference intensity is most evident among premium market segments and organizations investing in long-term ecosystem strategies. Pixel addresses a distinct but growing market category enterprises and technical professionals demanding seamless Google Workspace connectivity and advanced Android security capabilities.

India’s smartphone landscape reveals distinct market segmentation patterns: iPhone commands 55% of the premium device category (priced above $520), establishing itself as the preferred choice.

Simultaneously, Apple’s production shift from China to India highlights supply chain diversification that may influence local pricing and availability. Previously this year, Apple has boosted iPhone exports from India. Google Pixel targets cost-conscious segments within the mid-tier market, achieving 2% total market penetration while previously capturing up to 10% of premium segment share indicating growing acceptance among consumers and enterprises adopting cloud-centric Android frameworks.

Both Apple and Google have built extensive ecosystems, but their philosophies diverge sharply shaping how each platform is adopted and leveraged by organizations worldwide. A company’s ecosystem & strategy to broaden its branches decides its long-term plans and status in the market.

Google Pixel employs value-based pricing tiers that challenge Apple’s premium positioning while maintaining healthy profit margins through services integration. Pixel devices typically offer 20-30% cost savings compared to equivalent iPhone models, creating compelling total cost of ownership advantages for large-scale enterprise deployments. This pricing strategy particularly appeals to organizations seeking to optimize device budgets without compromising security or functionality.

Apple’s premium pricing strategy reflects a deliberate focus on profit maximization and brand positioning. iPhone devices typically command 40-60% gross margins, enabling substantial R&D reinvestment while maintaining premium brand perception. Apple’s AI strategy isn’t just about new AI features but also reflects privacy-first approach. This strategy appeals to enterprises willing to pay premium prices for devices that minimize support costs, maximize user productivity, and integrate seamlessly with existing Apple deployments.

Google’s ecosystem strategy emphasizes services integration and cross-platform compatibility. Pixel devices offer optimized performance with Google Workspace, seamless Android Enterprise management, and superior integration with Chrome OS deployments.

Organizations using Google Cloud Platform, Google Analytics, or other Google business services often find that Pixel devices provide enhanced functionality and streamlined workflows compared to iPhone alternatives.

Apple’s tightly controlled ecosystem provides unmatched integration across devices, applications, and services. For enterprises already invested in Mac computers, iPad tablets, or Apple TV deployment, iPhone devices offer seamless data synchronization, unified management interfaces, and consistent user experiences.

This integration advantage becomes particularly valuable in creative industries, executive leadership teams, and organizations prioritizing user experience consistency. Even Apple’s AI strategy shifts as Siri may get powered by Anthropic or OpenAI, signalling a selective openness where third-party AI can enhance core services. In a strategic move earlier this year, Apple has increased iPhone trade-in value in China.

The enterprise positioning of both Apple and Google Pixel is fundamentally shaped by strategic partnerships and investment coordination within broader business technology ecosystems.

Apple has cultivated comprehensive enterprise integrations to reinforce its B2B market presence, while Google’s Pixel has capitalized on Android’s open architecture and Google’s extensive cloud and productivity service portfolio.

Google maintains established enterprise partnerships with Samsung, particularly through Samsung’s Knox Manage solution, which holds formal recognition in Google’s Android Enterprise Recommended program.

Both companies have aligned their core enterprise platforms to deliver integrated security and device management capabilities. This Knox integration provides organizations with secure, scalable mobile management solutions while strengthening Android Enterprise’s position in business mobility markets alongside Chromebook deployment support.

The global Mobile Device Management market, valued at $12.15 billion in 2024 and projected to reach $81.72 billion by 2032, represents a critical opportunity for both platforms. Google’s focus on SME adoption through Google Workspace integration has created natural synergies that simplify enterprise deployment and reduce management complexity for smaller organizations.

According to Apple’s official Newsroom, Apple and IBM announced an exclusive, landmark partnership in July 2014, explicitly aimed at transforming enterprise mobility. This collaboration focused on co-developing a new class of more than 100 industry-specific enterprise applications native apps for iPhone and iPad integrated with IBM’s analytics and cloud services, alongside custom AppleCare for business needs.

IBM also began selling iOS devices directly to business clients as part of this initiative, marking a major pivot for Apple into enterprise solutions while maintaining consumer market leadership.

In a recent development, Apple strengthens Tata Partnership with iPhone Repair Deal in India.

Recent survey data from 2024 demonstrates a growing enterprise appreciation for Apple’s security features. A Kandji/Digital Research global survey of 300 IT professionals responsible for Apple deployments in large companies found that 58% of IT professionals now cite security as the chief benefit of using Apple products. This jump reflects increased confidence in Apple’s enterprise security frameworks, device management tools, and privacy features.

The Google Pixel vs iPhone debate in the enterprise is a study in contrasting strategies. The iPhone’s blend of security, integrated ecosystem, and brand equity has made it a cornerstone in executive and enterprise mobility strategies. Apple’s approach is ideal for leaders seeking the combination of prestige, longevity, and uncompromising reliability.

On the other hand, the Pixel lineup stands out by providing organizations with flexibility, cost efficiency, and deep alignment with cloud-powered, collaborative workflows. For businesses seeking rapid deployment, innovation, and openness, Google’s approach is compelling especially in the context of scaling up with mixed device fleets and leveraging seamless workspace integration.

Sign up to receive our newsletter featuring the latest tech trends, in-depth articles, and exclusive insights. Stay ahead of the curve!