Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

CPA firms should consider investing in robust cybersecurity in accounting structures, especially with the increasing target from cybercriminals. Financial companies hold valuable data such as customers’ information and transactional details which must not fall into the wrong hands. Therefore, establishing your CPA accounting firm as a trustworthy financial option is important and includes protecting the confidentiality of every data in your systems.

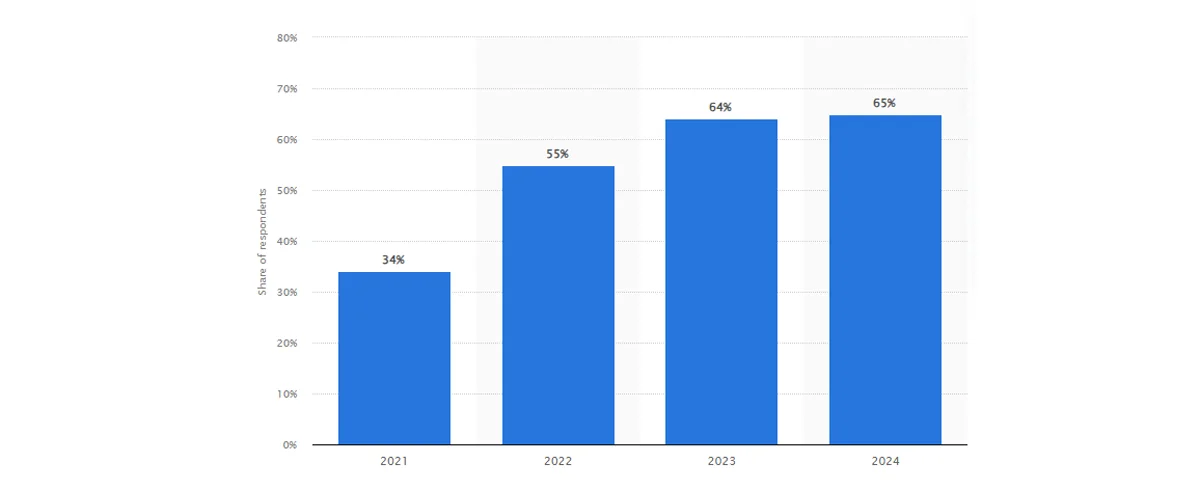

The digitalization and gradual migration to cloud accounting for many financial institutions has seen an increased cyberattack rate. According to Statista, the global percentage of financial companies that experienced ransomware attacks increased from 34% in 2021 to 65% at the end of the third quarter of 2024. This explains the benefits of understanding how cloud security works to minimize the risk of cyberattacks.

Source: Statista

Many financial institutions have updated their defense firewalls and patches since popular attacks like the MOVEit hacks reportedly spearheaded by the CI0p ransomware group in 2023. The attack exploited a flaw in the file transfer service hosted by Progress Software allowing unauthorized injections of SQL commands. Leading companies like British Airways and BBC were reported victims.

However, cybersecurity in accounting threats remains a concern in 2024 with more recent attacks like the mid-June incidents on CDK Global forcing a proactive shutdown of their systems. CNN reported the incident involving an alleged $25 million ransom payment to the associated Blacksuit ransomware hackers. Moneygram was another 2024’s victim as the financial company through an X update attributed a recent downtime in its services to a cybersecurity attack.

Despite the popularity of ransomware attacks, they are not the only cyber threat to financial companies. Cybercriminals are known to target accounting institutions through different malicious methods. Other major cybersecurity threats for accounting firms include:

Check out our top cyber security tips for accountants to effectively minimize the chances of falling victim to any financial data threats we listed above.

While creating a strong and unique password sounds like cheap advice, it is a robust step toward setting up your initial security frameworks. Whether desktop accounting or cloud computing financial methods, having a “strong and unique” password should function as fundamental cybersecurity in accounting practices for your firm.

A strong password should contain upper and lower-case letters, numbers, and special characters. It should also be different for separate accounts or systems to minimize the risk if one of your company’s accounts is breached.

Organize periodic cybersecurity for accountants training on the latest threats and cyber hygiene practices for a secure work environment. This includes letting your accountants know how to recognize phishing emails and why they must not click suspicious links. Regularly updating your certified public accountants ensures they become cybersecurity in accounting experts. They know their role in protecting sensitive financial information and how to avoid being the weak link for cyber scammers.

While we recommend security tips training for employees on the cybersecurity best practices for accounting firms, restricting access to sensitive data is a crucial policy. Use role-based access control systems to limit how employees can work on certain files. Employees in your CPA accounting company should be granted login permission to access only the data and systems necessary for their specific job functions. This greatly minimizes the chances of insider threats, data leaks, or accidental exposure.

Penetration testing is the simulation of a real ethical hack attempt to discover how your cybersecurity structure will defend against an actual cyberattack. A good example of penetration testing is attempting to access sensitive financial data by bypassing initial security measures to measure vulnerability levels. Cybersecurity in accounting experts can conduct periodic vulnerability assessments to identify potential threats like outdated software.

Cybersecurity best practices for accounting firms include compulsory compliance with standard accounting security regulations. These include the General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), and Consumer Privacy Acts depending on service locations.

Strict adherence to these legal standards and guidelines improves trust with your clients since they know that every collected financial data is stored and protected by the law. IT compliance readiness ensures data encryption, access controls, and audit trails to protect consumers’ data.

Technology plays a vital role in enhancing your cybersecurity defenses against potential threats from cybercriminals. Your Chief Information Security Officer (CISO) and network security administrators can manage daily accounting operations using these tools and software.

Strong and unique passwords can be so “strong” that you need a password manager to remember them on recognized devices. However, devices sometimes get compromised or physically breached by unwanted parties. A multi-factor authentication (MFA) is an additional layer of security for the user to verify their identity in such cases. An example is two-factor authentication which could be a unique hardware token, facial recognition, security question, or another passcode.

Encryption software ensures that financial information is unreadable to unauthorized users and only accessible through a decryption key. It is an effective cybersecurity for accounting technology to prevent unauthorized individuals from breaching the data while in transit or on cloud-based storage. BitLocker and VeraCrypt are examples of full-disk encryption tools.

Getting firewall and antivirus solutions is important cybersecurity in accounting practice to regularly scan to detect and block malware, ransomware, or other malicious activities. Examples of relevant technologies are Cisco Firepower and Norton 360 as barriers between your internal accounting network and external threats.

Data loss prevention tools like Microsoft DLP or Symantec DLP are technological software solutions for monitoring and protecting sensitive accounting data from leaks or unauthorized access. An example is a blocked action notification or cybersecurity alert if an employee tries sending confidential accounting information through the company’s email to an external recipient. DLP tools also improve regulatory compliance in protecting financial information like credit cards or social security numbers.

Adopting cloud-based technology servers like Microsoft Azure Security Center and Amazon Web Services (AWS) Shield can help secure cloud infrastructure. Information systems security managers can implement these tools to offer real-time monitoring, threat detection, and automated defense response to malicious attempts.

Fraud protection is one of the applications of AI and machine learning in identifying and neutralizing cyber threats for accounting firms. AI-driven platforms such as Darktrace use technologies such as neural networks, predictive analytics, deep learning, and NLP to detect unusual patterns and behaviors in your financial systems. They alert security teams to potential cyberattacks before they escalate.

As cybercriminals become more innovative, financial institutions must stay ahead by implementing cybersecurity in accounting checklists to protect their systems. We already explained the state of accounting cybersecurity attacks and the role of technology in minimizing the chances of a cyberattack on your cloud computing infrastructures. Learning how to protect your financial data is a continuous practice that requires readiness to implement new data safety policies while ensuring compliance with industry regulations.

Sign up to receive our newsletter featuring the latest tech trends, in-depth articles, and exclusive insights. Stay ahead of the curve!