Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

The growing reliance on digital infrastructure has made Cloud FinOps strategies an important focus for global business leaders in 2025. Computing costs continue to rise, driven by the expansion of data centers and the adoption of AI-powered workloads. While traditional cloud cost management methods have been useful, they struggle with static budgets and delayed reporting.

FinOps as a practice offers a solution by enabling a culture of real-time expense tracking and shared financial responsibility across teams. This article explains how Cloud FinOps works, how it differs from traditional cost management, and the ways it can drive B2B success in 2025.

Cloud FinOps, short for Cloud Financial Operations, is not a single tool or product but a discipline for managing cloud spending more effectively. It promotes shared financial responsibility among finance, engineering, product, and business teams to ensure better cost governance.

B2B companies seeking real-time visibility and cost optimization of their cloud resources can leverage FinOps-as-a-Service platforms and tools. As Cloud FinOps solutions, they help provide instant metrics and alerts to track expenses, ensuring that every dollar spent creates measurable business value.

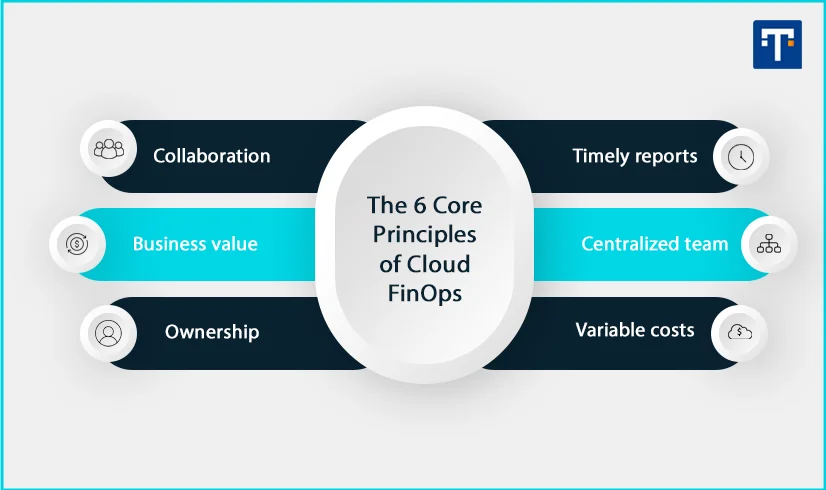

According to the FinOps Foundation, which represents more than 15,000 companies, the six core principles of Cloud FinOps are:

With traditional financial management software, decisions on cost planning are usually made after the expenses have already occurred. This means companies react to overspending problems rather than preventing them. However, Cloud FinOps offers a better solution in the following ways:

Modern FinOps services provide organizations with real-time visibility into cloud resource usage and costs. A SaaS company using FinOps will receive a proactive automated alert if there is an idle server mid-month, rather than waiting until the month-end for an invoice surprise. Traditional cloud cost management is reactive, and such budget overruns are only observed when the monthly bill arrives.

Traditional cost management models rely on centralized finance teams making most decisions, with engineers and product teams having little input. However, a proper Cloud FinOps strategy enables shared accountability and collective responsibility by setting budgets per department.

The principle of FinOps prioritizes spending that delivers measurable business outcomes. For example, the marketing team can reallocate unused cloud credits from a low-performing campaign to another project with better ROI. Fixed budgeting under traditional cloud cost control does not allow this flexibility.

FinOps strategies include continuous monitoring and forecasting, unlike the rigid annual or quarterly planning cycles for traditional cloud cost management. For example, a SaaS provider using Cloud FinOps can use automated daily reports to optimize cloud computing for better monthly performance metrics.

Traditional cost management uses reports that lag behind actual cloud usage. Cloud FinOps tools such as IBM Cloudability can combine real-time billing data from multi-cloud sources like AWS and Azure into a single dashboard. The instant visibility features make it easy to spot spending patterns and performance.

One reason for the growing adoption of Cloud FinOps strategies is the real-time cost control over the delays of traditional cloud cost management. Rising computing expenses and sustainability trends, such as green cloud computing, are also driving companies to find better ways to manage IT spending. Here are the advantages of FinOps services for B2B success in 2025:

Advanced FinOps tools, such as IBM Cloudability and CloudZero, help business leaders gain unified cost insights even when using multi-cloud technology. The real-time data that Cloud FinOps provides means smarter enterprise cloud cost management by avoiding hidden expenses.

The ability to forecast demand, adjust resource allocation, and shift investments in a fast-paced cloud computing market is what sets apart the leading business leaders. Using FinOps services for B2B cloud cost management helps business leadership make strategic decisions ahead to gain a competitive advantage.

Budgeting remains important even when shifting from traditional cost practices. While FinOps supports flexible financial management, it leverages big data and analytics to minimize budget surprises. This is essential for B2B companies aiming for stability in their enterprise cloud cost management.

Chief Technology Officers (CTOs) and Chief Financial Officers (CFOs) sometimes have competing priorities. For example, engineers may prioritize performance while the finance team seeks cost control. Cloud FinOps helps align these objectives through shared accountability and transparency principles for collaborative cloud cost governance rather than conflicting ones.

When implemented properly, successful cloud cost management becomes a culture of optimizing resource usage for measurable outcomes. It goes beyond tracking invoices to fostering accountability, adopting proactive frameworks, prioritizing long-term business value, and using the right cost management tools. Here are actionable steps for B2B leaders to build an effective FinOps strategy in 2025:

Strong enterprise cloud cost management involves holding each team accountable for its resource consumption and financial outcome. Clearly define FinOps strategy roles across departments to eliminate blind spots in financial reports of finance, engineering, and product teams.

The success of Cloud FinOps strategies of any organization depends on using the right tools. Consider platforms that provide real-time dashboards and forecast data to help decision-making. Examples of FinOps tools to manage cloud cost governance include CloudZero, AWS Cost Explorer, and IBM Cloudability.

Manual monitoring of resource utilization or active workloads in a modern cloud computing environment is too slow for the scale of current demands. Automate processes such as shutting down idle resources to achieve better cloud cost optimization and boost productivity.

B2B leaders can only build an effective Cloud FinOps strategy when they allow cross-team collaboration across departments to align technical performance and business goals. Implement a culture of shared responsibility for cloud spending decisions to improve resource utilization and ROI.

Implementing the essential FinOps practices is a continuous process that should reflect your business needs and customer demands in real-time. Ensure a lasting enterprise cloud cost management strategy that is adaptable through periodic reviews.

Embracing Cloud FinOps strategies in 2025 means approaching cost management as a routine part of daily operations and not a one-time or quarterly task. B2B leaders should ensure that every team understands how their financial decisions collectively contribute to the shared business goals. This is possible through employee training and the right FinOps tools for smarter cloud resource usage. Building an effective cloud cost governance framework benefits the company by enabling accurate budgeting, predictable financial outcomes, and a higher return on investment.

Sign up to receive our newsletter featuring the latest tech trends, in-depth articles, and exclusive insights. Stay ahead of the curve!