Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

The performance of the smart manufacturing market in the Asia-Pacific (APAC) region is an important factor in its continued economic development. With production demands usually rising in Q4, the integration of artificial intelligence (AI) and the Internet of Things (IoT) enables smart factories to operate more efficiently than traditional production lines.

Companies with smart manufacturing systems can scale up production while maintaining quality and meeting delivery timelines. This guide explores the rise of smart factories, the role of AI and IoT in smart manufacturing, and challenges with adopting these technologies.

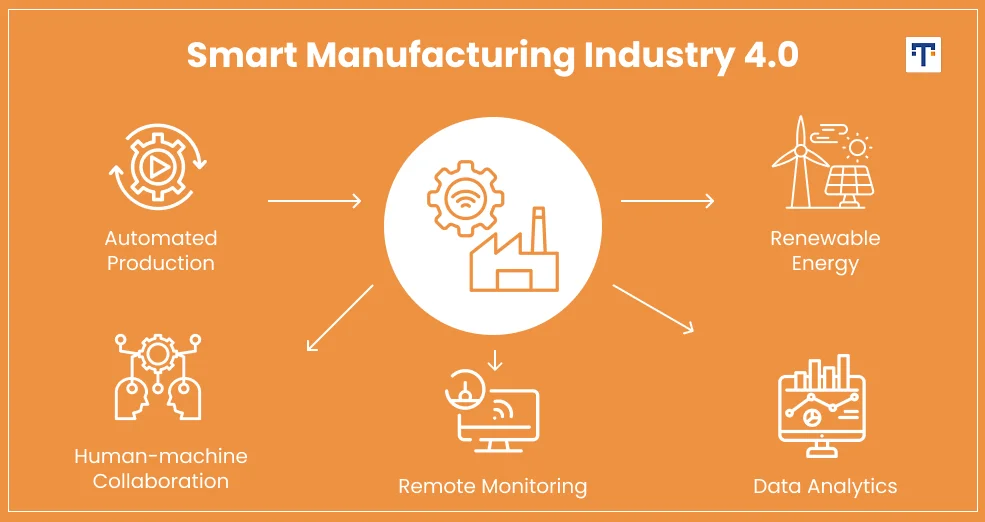

Smart manufacturing is the integrated use of digital technologies, such as IoT, AI, big data, and cloud computing, to build intelligent production systems. These systems enhance efficiency, productivity, and sustainability in modern factories.

As a core application of Industry 4.0, the smart manufacturing market relies on real-time data to optimize processes and improve overall system performance. The industrial journey progressed from Industry 1.0, driven by mechanization in the 18th century, to Industry 2.0, which supported mass production. Further improvements led to Industry 3.0, characterized by automation and IT. We have now reached Industry 4.0 where AI and IoT are among the leading technologies shaping industrial growth, particularly in addressing supply chain challenges in the APAC region.

Smart factories rely on IoT to generate real-time data and AI to interpret that data. The integration of these technologies is referred to as the artificial intelligence of Things (AIoT). Here is how it affects the efficiency of the smart manufacturing market in the APAC region:

IoT for a smart factory refers to networks of connected sensors, devices, and machines that collect and share operational data across the production floor. Leading manufacturers, such as Toyota, have been working on IoT-enabled robotics in their assembly lines to enhance efficiency and reduce risks from handling overheated components. Any plant that automates control of its operations depends on IoT applications to enable continuous tracking of production lines, monitor machine health, and enhance worker safety through connected systems.

The vast streams of data produced by IoT in supply chain operations only become valuable when analyzed by AI. Smart factories use AI to identify actionable trends and patterns that improve supply chain and logistics. This includes analyzing data to optimize transport routes, balance inventory levels, and assess supplier performance. These AI-driven insights help minimize bottlenecks and make scaling during high-demand periods, such as Q4 export surges, far more reliable.

After IoT collects data and AI analyzes it, the next step is predictive analytics. This involves using AI models to identify patterns from continuously generated data and predict potential problems before they cause unplanned downtime. In APAC’s smart manufacturing market, this proactive approach not only prevents disruptions but also helps optimize broader systems, such as fleet management through predictive analytics. The ability to reduce costs while keeping production output steady through optimized systems makes predictive maintenance one of the most valuable applications of IoT in smart manufacturing.

The advantages of AI and IoT in driving the expansion of the smart manufacturing market in the Asia-Pacific region span both industrial and economic dimensions. Manufacturers leveraging automated and data-driven production systems are actively contributing to GDP growth, trade performance, and global competitiveness in the following ways:

By enabling real-time monitoring of factory floor systems and generating predictive insights, industrial smart manufacturing solutions ensure greater consistency in production cycles. In the Industry 4.0 era, the ability to deliver high-quality products on schedule is a key differentiator for APAC manufacturers aiming to meet rising global demand.

Rising production costs continue to be a challenge for manufacturers worldwide. Traditional firms often respond by cutting quality or increasing product prices. However, a smart factory powered by AI and IoT will address these challenges differently. By optimizing production processes with real-time data, they can achieve efficiency gains without sacrificing quality. This will strengthen buyers’ confidence and secure a stronger foothold in international markets.

One of the defining advantages of industrial smart manufacturing solutions over traditional models is the ability to scale output without proportionally increasing financial or material inputs. An example is the Innowise smart factory app development that led to 20- to 30% higher productivity. This means APAC manufacturers can leverage AI and IoT to streamline supply chains, enhance logistics, and reduce downtime or resource waste. This efficiency not only drives higher production volumes but also contributes to national revenues and regional GDP growth.

Policies such as Japan’s Smart Manufacturing Development (SMD) Guideline and China’s establishment of over 30,000 smart factories are regional strategies driving AI and IoT adoption. APAC manufacturers must also remain aligned with global legislative frameworks, including the EU AI Act updates and international data privacy laws. Building compliance strategies around both regional and global policies is critical, as it ensures regulatory readiness, long-term growth, and competitiveness in the global smart manufacturing market.

Despite the promising opportunities in the smart manufacturing market, widespread adoption still faces significant challenges. The main limitations to implementing artificial intelligence (AI) and the Internet of Things (IoT) in a smart factory are:

While the benefits of digital transformation in manufacturing are clear, the initial investment to migrate from traditional production processes to AI and IoT-driven systems is a barrier to many small and medium-sized enterprises (SMEs). Beyond financial constraints, workforce readiness is also a concern. Smart manufacturing demands advanced technical skills and ongoing training programs to ensure teams can operate and adapt to evolving global standards.

Effective IoT deployments rely on networks of connected sensors, devices, and machines that transmit and share data in real-time. However, this connectivity introduces vulnerabilities to cyber scams through weak links that can be used to expose sensitive production data or disrupt operations. To mitigate these risks, enterprises must understand IoT security guidelines and enforce compliance requirements for third-party vendors with access to internal systems.

When IoT provides real-time visibility and AI supplies predictive intelligence, the effect is on manufacturers to scale output of quality deliveries without necessarily increasing production costs. This potential of the smart manufacturing market is why leaders across the Asia-Pacific region must prioritize targeted investment, workforce upskilling, and robust cybersecurity strategies.

Policies to support the digital manufacturing market for SMEs should also be encouraged while ensuring alignment with national Industry 4.0 strategies and global standards. Leading the next phase of competitive production is for governments and stakeholders who see smart manufacturing as a necessity and not just an optional upgrade.

Sign up to receive our newsletter featuring the latest tech trends, in-depth articles, and exclusive insights. Stay ahead of the curve!