Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

In 2025, B2B payments are undergoing one of the most significant transformations in decades, driven by technological advancements and changing business needs. For years, companies experienced slow bank transfers, piles of paperwork, and little visibility into where their money was.

Now fintech tools, blockchain, and smart contracts are coming together to change that. For instance, Galileo’s new wire transfer API offers a faster and more secure money transfer option to address these issues.

These technologies are helping enterprises move away from slow, opaque systems toward enterprise payment systems that are faster, clearer, and more automated, by replacing manual steps with digital ones.

Traditional enterprise payments weren’t built for global, on-demand business and often involve slow settlement times and limited transparency. International bank transfers can take up to five days, and tracking payment status or tracing missing payments can be challenging, especially for cross-border transactions.

Fintech companies are addressing these issues by offering faster, more transparent solutions. India’s digital infrastructure has been transformed by UPI, serving as a case study in building secure, scalable, and cost-effective digital infrastructure.

They provide real-time payment tracking, up-front transaction fees, and reduced reliance on intermediaries, which can lower costs and improve efficiency.

These Next-Gen fintech innovations are particularly beneficial for small and medium-sized enterprises (SMEs), which often face higher transaction costs and longer settlement times than large corporations.

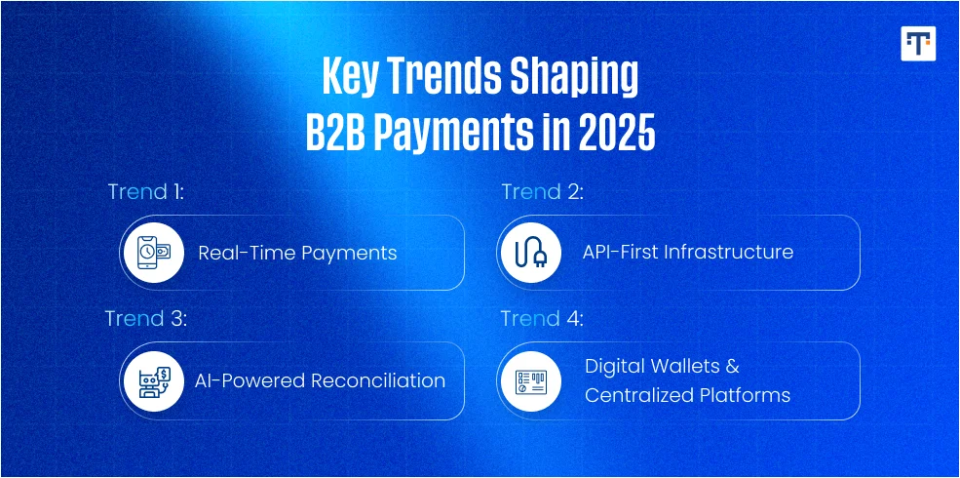

The way businesses send and receive money is changing quickly. Here are some of the trends shaping the way businesses will pay and get paid in 2025 and beyond.

These are transactions that settle instantly, moving money between accounts in seconds instead of days. This gives finance teams better control over cash flow, and adoption is growing fast. In the next few years, real-time payments are expected to make up a much bigger share of business transactions. Global real-time transactions are projected to reach over 575 billion by 2028.

Modern enterprise payment systems are built as modular services you plug into existing ERP or treasury systems. That means companies don’t have to rip everything out to go modern. They can add APIs that link billing, treasury, and reconciliation tools. This type of integration allows, for example, ERP systems to automatically generate invoices, treasury dashboards to show real-time payment statuses, and accounting software to reconcile transactions instantly. This approach makes integration faster for banks and fintechs.

Reconciliation used to mean hours of checking invoices against payments. Now AI and machine learning handle most of it by matching records automatically, spotting mismatches, and suggesting corrections. This cuts down on errors and helps finance teams close the books faster.

Digital wallets are becoming a standard tool in B2B payments. Enterprises don’t have to rely only on banks for every transfer. They can make transactions directly inside the wallet. Centralized platforms take it further by putting everything in one view. Finance teams can see what’s being paid and what’s coming in without switching between systems, making it easier to manage cash flow.

Wakanow Group, a major travel tech company in Africa, started using Outpayce’s B2B wallet to pay suppliers like hotels and airlines. Each payment triggers a virtual card that’s automatically generated based on currency and supplier rules. This setup sped up payments, cut fraud risks, and cleared invoices faster, suppliers no longer have to wait the usual 30 days to get paid.

Blockchain has always been associated with and regarded as the backbone of cryptocurrencies. But now, it is also shaping how enterprises handle cross-border payments, trade, and financial transactions.

Blockchain’s image used to be all about crypto, but that is changing. In enterprise payments, its biggest value is creating a single source of truth. Alpha Group’s acquisition by Corpay expands cross-border payment capabilities, enhancing transparency and efficiency.

Everyone involved in a transaction sees the same, tamper-proof record, and this helps prevent mistakes, reduces fraud, and avoids the confusion that happens when each bank or partner keeps their own separate records.

1. Cross-Border Payments with Traceability: Sending money abroad usually takes a long route through several banks, which can add fees and delays. With blockchain, both sides can see the transaction in real time on a shared ledger. Payments move directly between people and are verified by the network, cutting out the middlemen.

2. Global Trade Finance: Trade finance is usually slow because it depends on piles of documents and back-and-forth between banks, buyers, sellers, and shipping firms. Blockchain avoids this by putting the documents and approvals on a single shared system. That way, each party has access to the same information at the same time, approvals happen faster and settlements don’t drag on for weeks.

3. Trust-Driven Ecosystems: A shared, unchangeable ledger means everyone sees the same record. Since no one can change it, there’s less chance of arguments or confusion. This clear, open view makes it easier to check transactions and helps business partners trust each other.

In 2024, UBS announced that they successfully piloted a blockchain-based payment system to improve efficiency of cross-border transactions known as UBS Digital Cash. This allowed corporate clients and banks to settle payments in multiple currencies automatically through smart contracts. Transactions that normally took hours or days are now settled nearly in real time, and participants have gained clear visibility into intraday cash positions. Pilot users said that it made global payments faster, more transparent, and much simpler to trace.

Smart contracts are self-executing agreements coded on a blockchain. They automatically perform actions, like releasing payments, when predefined conditions are met. In B2B digital payments, this automation replaces manual approvals, streamlining processes and reducing delays.

Automation of Cross-Border B2B Payments: When a supplier ships goods and the carrier confirms delivery, a smart contract can automatically release payment when those confirmations arrive. That reduces manual approvals and speeds cash to the supplier.

Enhanced Compliance: Regulatory checks, tax computations, and sanctions screening can be built into the payment logic or system. When rules are part of the code, compliance becomes more consistent and auditable.

Reduced Friction: Fewer manual steps mean fewer delays and fewer mistakes. For procurement and trade finance, smart contracts can cut days off settlement times that usually last long.

For example, Komgo — a blockchain trade-finance platform backed by major banks digitized letters of credit and related workflows for commodity trade. Komgo’s platform automates several trade processes and reports large reductions in time to issue and process documents, illustrating how smart contracts and shared ledgers can make procurement and trade finance faster and more reliable.

Fintech, blockchain, and smart contracts are changing B2B payments. They help turn slow, paper-heavy processes into faster and more reliable ones.

These changes will keep moving forward. Payments will get quicker, automation will do more work, and transactions will be easier to track. Global trade finance is going digital with blockchain, and almost every transaction is becoming paper-free.

Companies that adapt to these changes fast will have an edge in global markets. While those who wait longer will find themselves behind as automated payment systems that are faster and more transparent become the norm.

Sign up to receive our newsletter featuring the latest tech trends, in-depth articles, and exclusive insights. Stay ahead of the curve!