Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

Nvidia experienced a setback as its shares fell by 3% after the new AI chip announcement. According to Yahoo Finance, the tech giant revealed its next-generation AI chip at its annual GTC event in San Jose on Tuesday, highlighting its capabilities in robotics and autonomous vehicle development.

Despite great expectations for its new AI chip models, the market responded in a cautious way due to Trump’s tariffs which led to an unexpected fall in Nvidia’s stocks. The announcement, which was meant to highlight Nvidia’s ongoing leadership in AI hardware, triggered mixed reactions from investors and analysts.

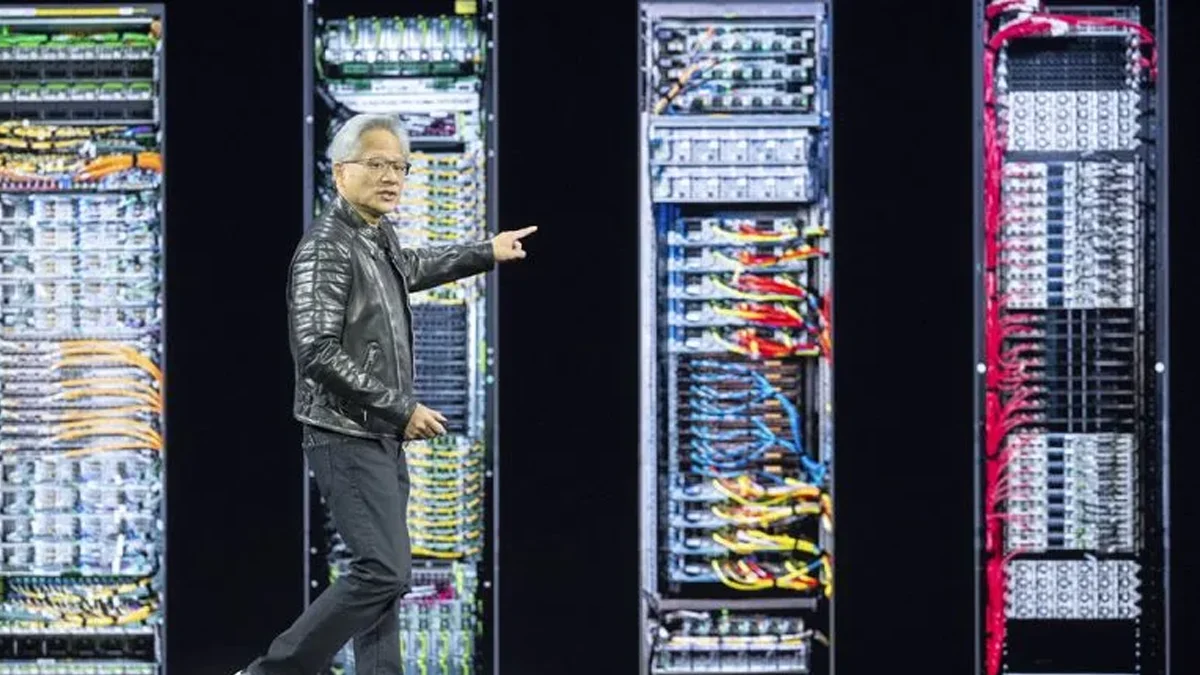

The new chip is a key successor to Nvidia’s Blackwell chips which is set to begin its shipment in 2025. The new upgraded chip can handle more tasks in the same amount of time. This new upgrade will help the providers generate 50 times more revenue in comparison to its predecessor Hopper GPU. CEO Jensen Huang said, “We designed Blackwell Ultra for this moment — it’s a single versatile platform that can easily and efficiently do pretraining, post-training, and reasoning AI inference.”

The AI market impact on Nvidia was quick as news spread across trading floors. Although Nvidia is still a top player in AI hardware, the launch of new chips stirred concerns about future market dynamics and competitive pressures. In February 2025, when Nvidia announced tighter Q4 profits which made Wall Street skeptical in spite of the company’s AI growth.

Analysts cited competitors catching up fast and having the potential to threaten Nvidia’s commanding lead. Josh Gilbert, a market analyst at eToro Australia said, “Investors may see that as an opportunity, particularly with its valuation remaining attractive on the backdrop of ongoing growth.”

In addition, with global economic instability and increasing tech regulation, investor sentiment suffered, manifesting in the performance of the stock. The market response highlights how closely the movement of Nvidia’s stock is linked to developments in the AI industry and investor sentiment.

The recent drop in Nvidia’s shares also points to broader stock market trends affecting tech businesses engaged in AI research. With AI waves riding high, Nvidia’s supplier Ibiden plans for a faster expansion to meet the growing demand.

The decline in Nvidia stocks comes as a reminder of the volatility that characterizes the AI space, with sudden technology changes and strong competition likely to affect market valuations rapidly. Investors are keenly observing as the industry keeps evolving, weighing the optimism regarding the future of AI against fear of risk.

The Nvidia New AI chip announcement was meant to solidify the company’s position in the market. But the resultant effect of the immediate AI market effect on Nvidia and the subsequent Nvidia stock drop shows the intricacies involved in Nvidia’s continued leadership.

Although the Nvidia stock forecast suggests a possible recovery, overall share market trends indicate further volatility. The performance of Nvidia in the next couple of months will greatly rely on how well it manages competitive forces, economic headwinds, and market expectations in the fickle AI arena.

At the event, Jensen Huang talked about AI and AI agents, saying, “In the last 2 to 3 years, a major breakthrough happened, a fundamental advance in artificial intelligence happened. We call it agentic AI. It can reason about how to answer or how to solve a problem.”