Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

There’s no doubt that Chinese startup DeepSeek has caused panic among AI investors. Tech stocks plunged on January 27 as the AI assistant overtook ChatGPT on the Apple App Store.

According to Yahoo Finance, big techs like Nvidia fear that DeepSeek will reduce chip demand. Its researchers have claimed that they developed an AI model that has less compute but one that can rival OpenAI’s o1.

Many tech investors wonder whether the market-sell off witnessed on Monday, January 27 was an overreaction or not. Some analysts hold that the reaction was overblown. They argue that efficient compute, which DeepSeek claims to offer, is not bad for demand. Tech leaders have also taken to social media to emphasize this point.

“Jevons paradox strikes again! As AI gets more efficient and accessible, we will see its use skyrocket, turning it into a commodity we just can’t get enough of,” Microsoft CEO Satya Nadella posted on X.

Jevons Paradox underscores that as the cost of using a resource drops, demand increases- it does not reduce. Pat Gelsinger, the former Intel CEO, also held a similar view.

“Computing obeys the gas law. Making it dramatically cheaper will expand the market for it. The markets are getting it wrong, this will make AI much more broadly deployed,” Gelsinger posted on X.

Both sentiments point to a desire for more efficiency and computing power.

In a scenario where more compute power and efficiency exist, AI companies can leverage it to free up efficient models elsewhere and scale faster.

“Everyone in the space is compute constrained. More efficient models mean those with compute will still be able to use it to serve more customers and products at lower prices & power impact,” Wharton Professor Ethan Mollick said.

Bernstein analysts agree with these sentiments saying, “any new compute capacity unlocked is far more likely to get absorbed due to usage and demand increase vs impacting long-term spending outlook at this point.”

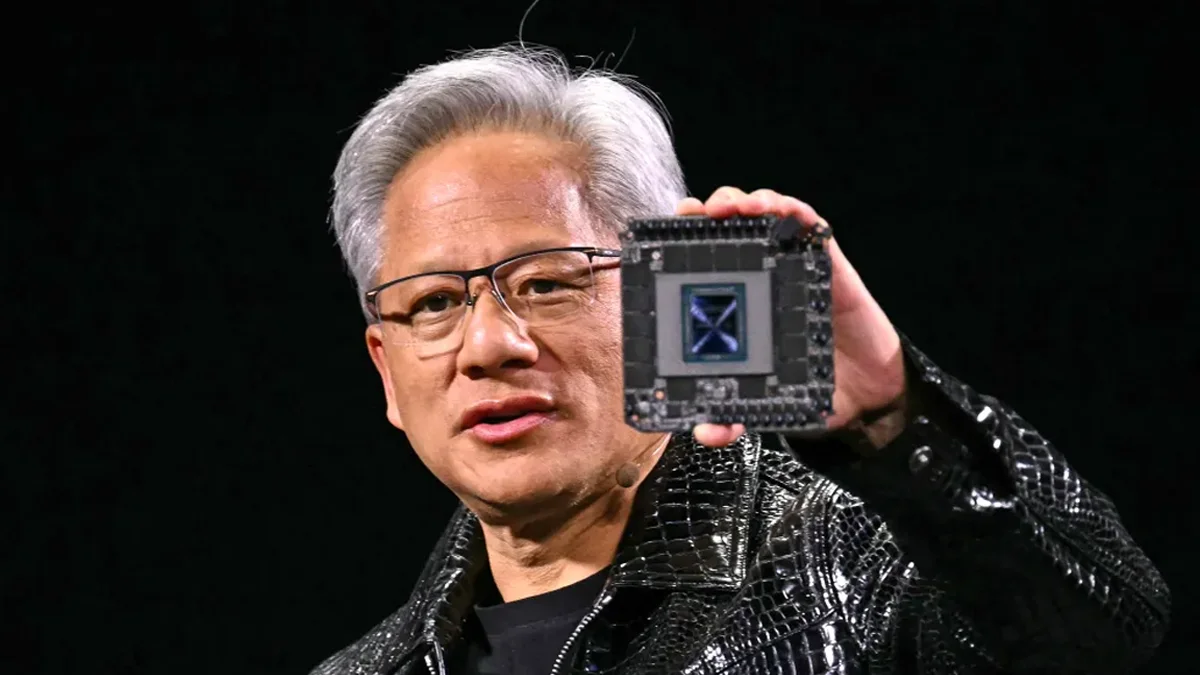

Nvidia stocks decline about 18% on Monday. The chip manufacturer said that the DeepSeek AI model is a great advancement and that the inference technique used in the model to analyze new information requires high performance networking and a high number of Nvidia GPUs.

Even with these perspectives, the market sell-off witnessed on Monday January 27 serves as a sobering reminder for many industry watchers. If the claims made by DeepSeek AI model developers turn out to be true, investors will become more conscious with AI investments and will have grounds to question whether big techs like Meta and OpenAI have to spend billions of dollars to purchase more chips.

“In my view, in the short-medium term, this could be bearish because maybe now the Big Tech firms that are doing all the capex will start focusing more on optimizing all their existing AI infrastructure rather than keep on acquiring more,” Morningstar Equity Analyst Javier Correonero said.

These sentiments were also echoed in an analysis by Enders which stated that, “DeepSeek is maybe just acting as a trigger point here for much broader investor unease around the returns on Big Tech AI capex and Nvidia’s continued rise.”

And as investors reel out of the stock plunge triggered by the DeepSeek self-off, some analysts say Monday events could be viewed through the market correction lens.

“The underlying narrative that drove equity performance in the past two years, that AI will profoundly change the world, is still very much relevant. The only thing that has changed is that some of the froth is being removed from valuations and earnings expectations, especially around Nvidia,” Forvis Mazars Chief Economist George Lagarias said.