Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

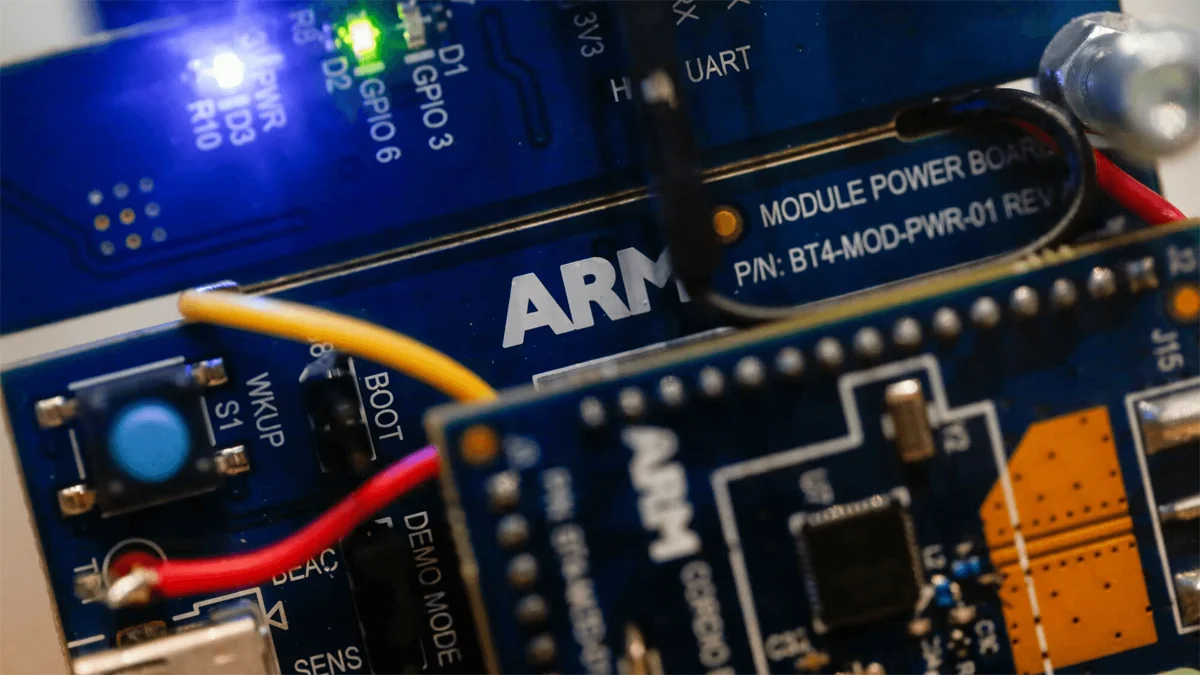

SoftBank’s Chip Designer Arm Holding Plc, a semiconductor technology company, is considering the acquisition of Ampere Computing. The acquisition of Ampere is in line with SoftBank’s continued practice to strengthen its portfolio and unveil increased growth in the competitive semiconductor market. This potential deal could be a real boost to SoftBank’s efforts in its market penetration strategy.

According to Yahoo Finance, the people connected to the deal also said that Ampere, the Oracle-backed semiconductor designer is drawing takeover interest from Arm while exploring other options. In 2021, Japanese SoftBank valued Ampere at $ 8 billion for an investment in California based firm.

The acquisition of Ampere Computing highlights the strategy of SoftBank’s market expansion on the technology portfolio. Ampere Computing is a company that has recently gained recognition for its new ARM-based processors focused solely on data center use. By this acquisition, SoftBank shall harness benefits from the increasing demand for efficient and high-performance chips in cloud computing. Recently, SoftBank has also been investing in AI to expand in newer markets.

The acquisition of Ampere Computing by SoftBank can be considered a calculated step in the direction of consolidating its position in the semiconductor sector. Ampere Computing uses Arm’s technology to manufacture semiconductor chips, so this acquisition will help the Japanese investor in its market expansion. Recently, Softbank’s Q2 profits for 2024 were also in the news as its tech investment started to pay off.

SoftBank’s Chip Designer Arm has played an important role in shaping the semiconductor market through its new designs. Arm Holdings’ deep-rooted presence in consumer electronics to enterprise solutions makes it a key player in the tech ecosystem.

The acquisition of Ampere Computing matches Arm’s stride in developing advanced processors aligned with the horizon of future computing demands.

Ampere’s ARM-based chips are targeted at hyperscalers, making it a fantastic asset for SoftBank. It would enable Japanese companies to better compete against other players while seeking market share in rapidly evolving cloud and data centers markets.

The acquisition of Ampere Computing would help SoftBank in strengthening its market expansion strategies. The deal would also provide Arm with a stronger footing in the semiconductor market. The analysts also expect that this will result in new partnerships and collaborations which may boost Japanese company’s dominance in the technological space.

The deal will no doubt attract attention from regulators and market analysts because the focus on consolidation in the semiconductor sector has been growing. However, SoftBank has a tradition of maneuvering at a sophisticated deal, which will provide it with good grounds for achieving this large acquisition.