Necessary Always Active

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

|

||||||

|

||||||

|

||||||

|

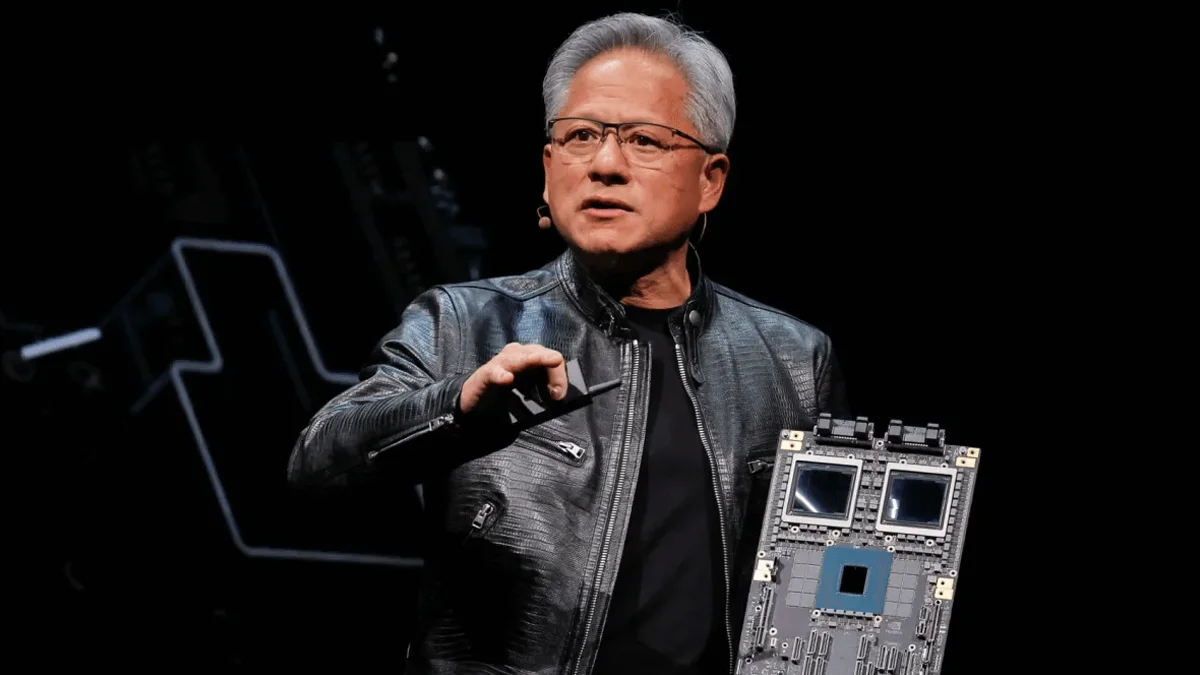

Nvidia CEO, Jensen Huang has termed Blackwell AI chip demand as ‘insane’ despite production delay. Huang’s comments about strong demand for Blackwell GPU chips pushed Nvidia’s share prices up by 3% on October 3, 2024 morning.

CNBC reported that Nvidia AI chip demand is high among big techs like Meta, OpenAI, and Microsoft. Companies that are putting up AI data centers to power products like Copilot and ChatGPT have also placed orders. Blackwell chips will cost up to $40,000 per unit.

Speaking on CNBC’s Closing Bell Overtime, Huang said “Everybody wants to have the most and everybody wants to be first.”

Huang’s sentiments about next-gen AI chip demand resonate with comments made by some of Nvidia’s largest customers like Oracle’s Larry Ellison. In September 2024, Ellison said that he and Elon Musk had dinner with Huang where they begged Huang for more GPU chips

Huang also talked about Blackwell AI chip production during the interview, saying that production is now on course and going as planned. In August 2024, Nvidia said the launch of Blackwell AI chips would be delayed for three or more months due to design flaws.

Huang also used the CNBC interview to reiterate that Nvidia is on track to deliver an efficient and faster GPU chip to its customers each year.

“If we can increase the performance as we’ve done with Hopper to Blackwell by two to three times each year, we’re effectively increasing the revenues or the throughput of our customers on these infrastructures by a couple of times each year, or you could think about it as decreasing costs every two or three years,” Huang said.

The Nvidia CEO emphasized that the company is working across the different layers of the computing stack, from software components to networking, and GPU chips

“This is a brand new way of doing computing, and we’re dedicated to build the entire stack and reinvent every layer of the technology stack so that every company in the world can benefit from this revolutionary new technology we call AI,” Huang said.

Nvidia is a major beneficiary of the AI boom. The value of Nvidia shares has increased by about 150% to date while its quarter two revenue hit $30.04 billion this year. The company expects sales revenue to hit the $32.5 billion mark this quarter.

“At a time when the technology is moving so fast, it gives us an opportunity to triple down, to really drive the innovation cycle so that we can increase capabilities, increase our throughput, decrease our costs, decrease our energy consumption. We’re on a path to do that, and everything’s on track,” Huang added.

Nvidia Blackwell AI chip demand is driven by their ability to train AI models at fast speeds while consuming less energy. The company expects to ship Blackwell products to Oracle, Google, Microsoft, and Amazon by the end of 2024.